The Runners Shop (TRS) was a family-owned business founded 17 years ago by Robert and Andrea Johnson.

Question:

The Runners Shop (TRS) was a family-owned business founded 17 years ago by Robert and Andrea Johnson. In July of 2018, TRS found itself experiencing a severe cash shortage that forced it to file for bankruptcy protection. Prior to shutting down its operations, TRS was engaged in the retail sale of athletic footwear and related products for runners. TRS’s 2017 audited financial statements reported net sales of $2,217,292 and a net loss of $50,980. Consistent with prior years, sales were strongest in the second and fourth calendar-year quarters, with the first calendar-year quarter substantially weaker than the rest. The company’s basic strategy was to provide superior customer service compared to competing sporting goods and mass merchandiser retail stores. The company attempted to provide superior service by hiring college-age runners as sales staff and then training them on shoes and strategies that would correct common running ailments. This approach helped TRS develop a very loyal customer base for its first store located in Charlottesville, Virginia. Sales at the Charlottesville store were so strong that Robert and Andrea decided to expand into three other markets: Richmond, Virginia; College Park, Maryland; and Raleigh, North Carolina. Unfortunately, the expansion effort did not go as well as Robert and Andrea had anticipated. They expected that the first three years of operations at the new locations would be difficult, but after that point they had hoped to experience significant improvement. However, the expected performance improvement did not materialize and after five years of operations the expansion stores were still running at a loss. In July 2018, Robert and Andrea, with almost all of their personal assets exhausted, realized they could no longer hang on and filed for bankruptcy protection.

REQUIRED

[1] Describe the purposes of audit documentation and explain why each purpose is important.

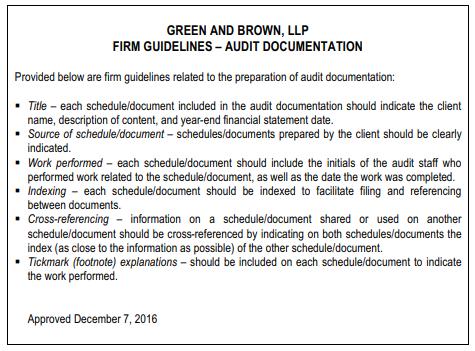

[2] Review Green and Brown, LLP’s audit documentation guidelines and explain why an audit firm would want to include each of the listed items in its audit documentation.

[3] Green and Brown, LLP would not be required to comply with the auditing standards of the Public Company Accounting Oversight Board (PCAOB) for the TRS audit because TRS is a private company. Setting this fact aside for the moment, go to the PCAOB Website and review Auditing Standard 1215 “Audit Documentation” (see www.pcaob.org). This standard requires that documentation of audit work contain sufficient information to enable an experienced auditor not involved with the engagement to achieve two objectives. What are those two objectives? Explain whether you believe the audit documentation in this case achieves these objectives.

Step by Step Answer:

Auditing Cases An Interactive Learning Approach

ISBN: 9780134421827

7th Edition

Authors: Mark S Beasley, Frank A. Buckless, Steven M. Glover, Douglas F Prawitt