Your client, Edgartown Corporation, provided the following schedule of land, buildings, and equipment for the audit of

Question:

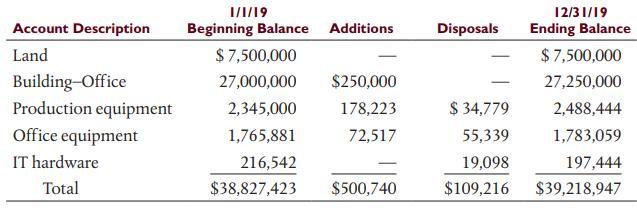

Your client, Edgartown Corporation, provided the following schedule of land, buildings, and equipment for the audit of financial statements for the year ended December 31, 2019:

a. What type of evidence would you examine to support the beginning balances in the accounts?

b. What types of evidence would you use to support the additions to each account? How might the sources of evidence differ for additions to the building account and the equipment accounts?

c. What types of evidence would you examine to support equipment disposals?

d. What procedures would you perform related to the ending balances in the accounts?

e. In the audit of property, plant, and equipment accounts, auditors should consider whether there are any implications to other accounts in the audit.

(1) What other accounts might be impacted by the additions of buildings and equipment?

(2) What other accounts might be impacted by disposals of equipment?

Step by Step Answer:

Auditing And Assurance Services An Integrated Approach

ISBN: 9780135176146

17th Edition

Authors: Alvin A. Arens, Randal J. Elder, Mark S. Beasley