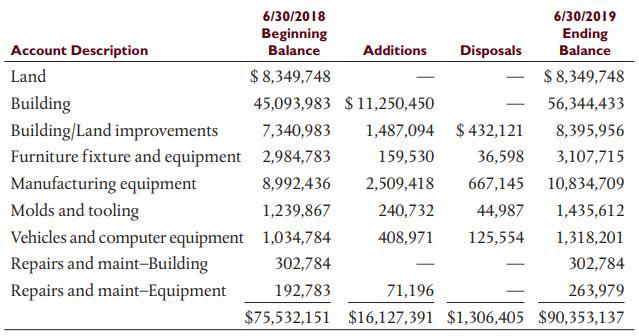

Your client, Schroeder Manufacturing Co., provided the following schedule of property, plant, and equipment for the year

Question:

Your client, Schroeder Manufacturing Co., provided the following schedule of property, plant, and equipment for the year ended June 30, 2019. Balances have been agreed to the general ledger. As part of the audit, the in-charge has asked you to perform procedures related to testing additions to the accounts using data provided by the client.

Download the PPEADDITIONS file (www.pearsonhighered.com/arens.com) from the textbook website and perform the following audit procedures using Excel, ACL, or IDEA. Document the steps followed for each procedure. A description of the codes and information contained in each column in the spreadsheet is included on the first tab.

Required:

a. Foot the file of additions to property, plant, and equipment for the year ended June 30, 2019, by asset code (ASSETCD) and agree to additions according to the schedule provided above. What audit objective(s) is (are) satisfied with this audit procedure?

b. Select all additions to the account greater than $25,000 for follow-up testing. How many items are identified and what is the total of the additions greater than $25,000? What further testing will the auditor perform for these acquisitions?

c. Identify all additions to property, plant, and equipment that were a result of significant repairs and maintenance (ASSETCD = RM - ME) for follow-up testing. How many items are identified? What further audit procedures will the auditor perform for these items?

d. Add an additional column to the spreadsheet and recalculate depreciation expense for each item. Schroeder uses straight-line depreciation, with a half-year convention (one-half year’s depreciation on all asset acquisitions and disposals during the year) and assumes zero salvage value. Document the results of the procedure and recommend follow-up if necessary.

e. Verify the sequence of asset tag numbers used and identify any duplicates or gaps. What audit objective(s) is (are) satisfied by this procedure? Document the results of the procedure and recommend follow-up if necessary.

Step by Step Answer:

Auditing And Assurance Services An Integrated Approach

ISBN: 9780135176146

17th Edition

Authors: Alvin A. Arens, Randal J. Elder, Mark S. Beasley