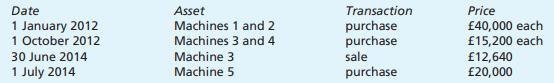

A Contractors Ltd was formed on 1 January 2012 and the following purchases and sales of machinery

Question:

A Contractors Ltd was formed on 1 January 2012 and the following purchases and sales of machinery were made during the first 3 years of operations.

Each machine was estimated to last 10 years and to have a residual value of 5 per cent of its cost price. Depreciation was by equal instalments, and it is company policy to charge depreciation for every month an asset is owned. Required:

(a) Calculate (i) the total depreciation on Machinery for each of the years 2012, 2013 and 2014; (ii) the profit or loss on the sale of Machine 3 in 2014.

(b) Contractors Ltd depreciates its vehicles by 30 per cent per annum using the diminishing balance method. What difference would it have made to annual reported profits over the life of a vehicle if it had decided instead to depreciate this asset by 20 per cent straight line? (Scottish Qualifications Authority)

Step by Step Answer:

Frank Woods Business Accounting

ISBN: 9780273759287

12th Edition

Authors: Frank Wood. Sangster, Alan