Oldfield Enterprises Limited was formed on 1 January 20X5 to manufacture and sell a new type of

Question:

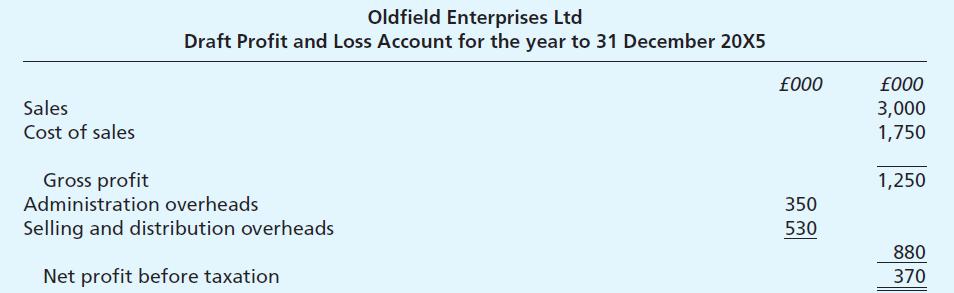

Oldfield Enterprises Limited was formed on 1 January 20X5 to manufacture and sell a new type of lawn mower. The bookkeeping staff of the company have produced monthly figures for the first ten months to 31 October 20X5 and from these figures together with estimates for the remaining two months, Barry Lamb, the managing director, has drawn up a forecast profit and loss account for the year to 31 December 20X5 and a balance sheet as at that date. These statements together with the notes are submitted to the board for comment. During the board meeting discussion centres on the treatment given to the various assets. The various opinions are summarised by Barry Lamb who brings them, with the draft accounts, to you as the company’s financial adviser.

Notes:

(a) Administration overheads include £50,000 written-off research and development.

(b) The lease is for 15 years and cost £75,000. Buildings have been put up on the leasehold land at a cost of £300,000. Plant and machinery has been depreciated at 15 per cent. Both depreciation and amortisation are included in cost of sales.

Opinions put forward

Leasehold land and buildings:

The works director thinks that although the lease provides for a rent review after three years the buildings have a 50-year life. The buildings should therefore be depreciated over 50 years and the cost of the lease should be amortised over the period of the lease.

The managing director thinks that because of the rent review clause the whole of the cost should be depreciated over three years.

The sales director thinks it is a good idea to charge as much as the profits will allow in order to reduce the tax bill.

Freehold land and buildings:

The works director thinks that as the value of the property is going up with inflation no depreciation is necessary.

The sales director’s opinion is the same as for leasehold property.

The managing director states that he has heard that if a property is always kept in good repair no depreciation is necessary. This should apply in the case of his company.

Plant and machinery:

The managing director agrees with the 15 per cent for depreciation and proposes to use the reducing balance method.

The works director wants to charge 25 per cent straight line.

Research and development:

The total spent in the year will be £425,000. Of this £250,000 is for research into the cutting characteristics of different types of grass, £100,000 is for the development of an improved drive system for lawn mowers and £75,000 is for market research to determine the ideal lawn mower characteristics for the average garden.

The managing director thinks that a small amount should be charged as an expense each year.

The works director wants to write off all the market research and ‘all this nonsense of the cutting characteristics of grass’.

The sales director thinks that, as the company has only just started, all research and development expenditure relates to future sales so all this year’s expenditure should be carried forward.

Stock:

Both the managing director and the works director are of the opinion that stock should be shown at prime cost.

The sales director’s view is that stocks should be shown at sales price as the stock is virtually all sold within a very short period.

Required:

(a) You are asked to comment on each opinion stating what factors should be taken into account to determine suitable depreciation and write-off amounts.

(b) Indicate what amounts should, in your opinion, be charged to profit and loss and show the adjusted profit produced by your recommendations, stating clearly any assumptions you may make.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273693109

10th Edition

Authors: Frank Wood, Alan Sangster