Durham Limited had an authorised capital of 200,000 divided into 100,000 ordinary shares of 1 each and

Question:

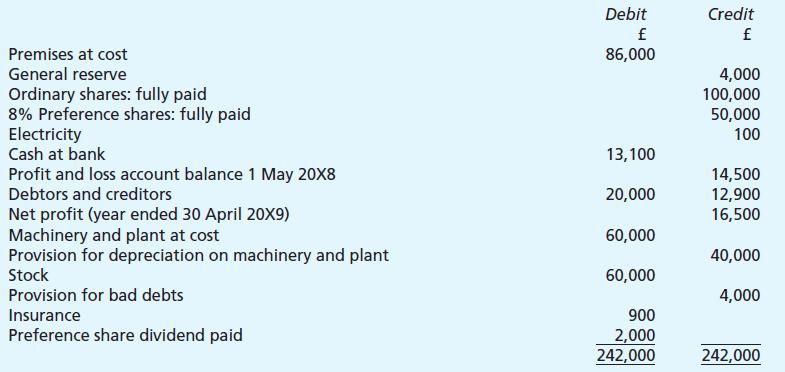

Durham Limited had an authorised capital of £200,000 divided into 100,000 ordinary shares of £1 each and 200,000 8% preference shares of 50p each. The following balances remained in the accounts of the company after the trading and profit and loss accounts had been prepared for the year ended 30 April 20X9.

The Directors have recommended:

A transfer of £5,000 to general reserve;

An ordinary dividend of £0.15p per share; and

A provision for the unpaid preference share dividend.

(a) Prepare the profit and loss appropriation account for year ended 30 April 20X9.

(b) Prepare the balance sheet as at 30 April 20X9, in a form which shows clearly the working capital and the shareholders’ funds.

(c) Identify and calculate:

(i) one ratio indicating the firm’s profitability;

(ii) two ratios indicating the firm’s liquidity position.

(d) Make use of your calculations in (c) above to comment on the firm’s financial position.

(e) Name two points of comparison which are not available from the information above in this question but which could make your comments in (d) above more meaningful.

Step by Step Answer:

Frank Woods Business Accounting Volume 1

ISBN: 9780273681496

10th Edition

Authors: Frank Wood, Alan Sangster