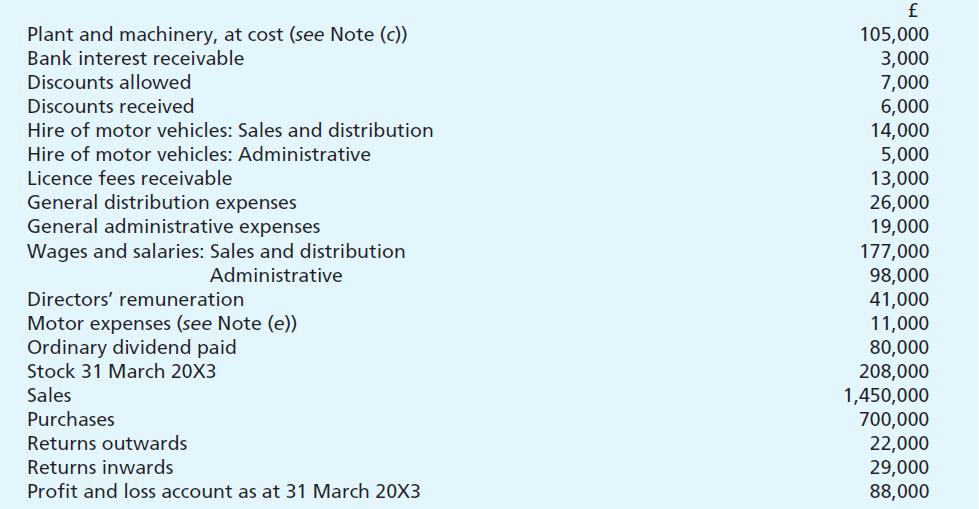

From the following balances in the books of Breaker plc you are to draw up (i) A

Question:

From the following balances in the books of Breaker plc you are to draw up

(i) A detailed trading and profit and loss account for the year ended 31 March 20X4 for internal use, and

(ii) A profit and loss account for publication:

Notes:

(a) Stock at 31 March 20X4 £230,000.

(b) Accrue auditor’s remuneration £8,000.

(c) Of the plant and machinery, £70,000 is distributive in nature, while £35,000 is for administration.

(d) Depreciate plant and machinery 25 per cent on cost.

(e) Of the motor expenses, 4/5 is for sales and distribution and 1/5 for administration.

(f) Corporation tax on ordinary profits is estimated at £143,000.

(g) A sum of £25,000 is to be transferred to general reserve.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273693109

10th Edition

Authors: Frank Wood, Alan Sangster