The Club Ltd was incorporated on 15 May 2017 and took over the business of Poker Ltd

Question:

The Club Ltd was incorporated on 15 May 2017 and took over the business of Poker Ltd on 1 June 2017. It was agreed that all profits made from 1 June should belong to The Club Ltd and that the vendors should be entitled to interest on the purchase price from 1 June to the date of payment. The purchase price was paid on 31 October 2017 including £6,600 interest.

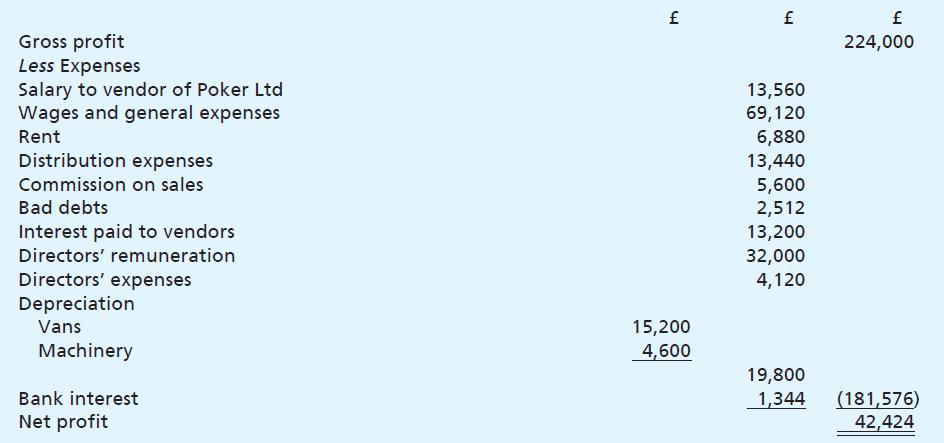

The following is the statement of profit or loss extract for the year ending 31 May 2018:

You are given the following information:

1 Sales amounted to £160,000 for the three months to 31 August 2017 and £400,000 for the nine months to 31 May 2018. Gross profit is at a uniform rate of 40% of selling price throughout the year, and commission at a rate of 1% is paid on all sales.

2 A salary of £13,560 was paid to the vendor of Poker Ltd for her assistance in running the business up to 31 August 2017.

3 The bad debts written off are:

(a) A debt of £832 taken over from the vendors;

(b) A debt of £1,680 in respect of goods sold in November 2017.

4 On 1 June 2017, four vans were bought for £56,000 and machinery for £40,000. On 1 August 2017 another two vans were bought for £24,000 and on 1 March 2018, another machine was added for £24,000. Depreciation has been written off vans at 20% per annum, and machinery at 10% per annum. Depreciation is written off for each month in which an asset is owned.

5 Wages and general expenses and rent all accrued at an even rate throughout the year.

6 The bank granted an overdraft facility in September 2017. Assuming all calendar months are of equal length:

(a) Set out the statement of profit or loss in columnar form, so as to distinguish between the period prior to the company’s incorporation and the period after incorporation;

(b) State how you would deal with the profit prior to incorporation;

(c) State how you would deal with the results prior to incorporation if they had turned out to be a net loss.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9781292085050

13th Edition

Authors: Frank Wood, Alan Sangster