Jean Marsh owns a small business making and selling childrens toys. The following trial balance was extracted

Question:

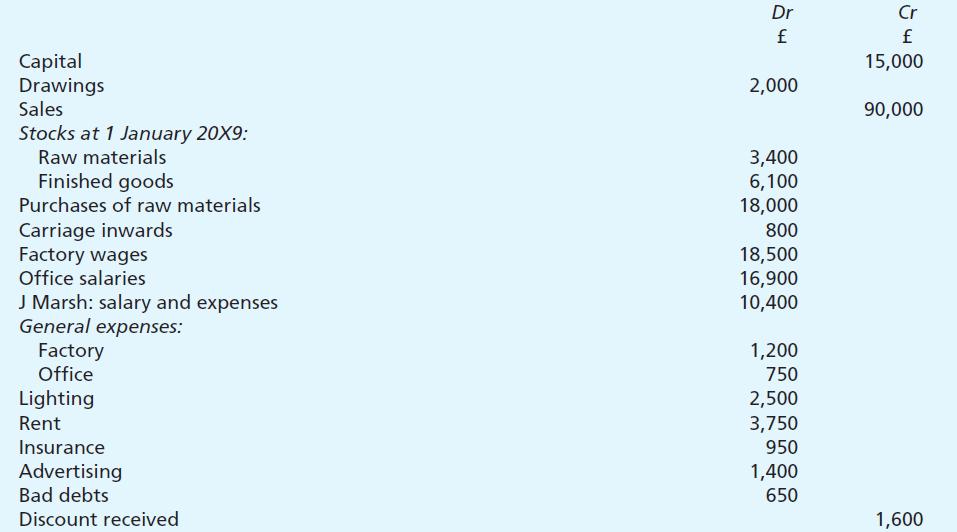

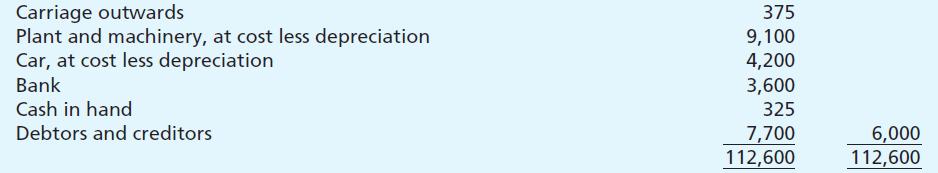

Jean Marsh owns a small business making and selling children’s toys. The following trial balance was extracted from her books on 31 December 20X9.

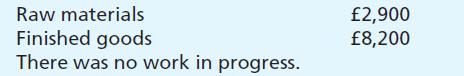

You are given the following additional information.

1. Stocks at 31 December 20X9

2. Depreciation for the year is to be charged as follows:![]()

3. At 31 December 20X9 Insurance paid in advance was £150 and Office general expenses unpaid were £75.

4. Lighting and rent are to be apportioned: 4/5 Factory, 1/5 Office Insurance is to be apportioned: 3/4 Factory, 1/4 Office

5. Jean is the business’s salesperson and her salary and expenses are to be treated as a selling expense. She has sole use of the business’s car.

Questions:

For the year ended 31 December 20X9 prepare

(a) A manufacturing account showing prime cost and factory cost of production.

(b) A trading account.

(c) A profit and loss account, distinguishing between administrative and selling costs.

(d) A balance sheet as at 31 December 20X9.*

Step by Step Answer:

Frank Woods Business Accounting Volume 1

ISBN: 9780273681496

10th Edition

Authors: Frank Wood, Alan Sangster