Lock, Stock and Barrel have been in partnership as builders and contractors for many years. Owing to

Question:

Lock, Stock and Barrel have been in partnership as builders and contractors for many years. Owing to adverse trading conditions it has been decided to dissolve the partnership. Profits are shared Lock 40 per cent, Stock 30 per cent, Barrel 30 per cent. The partnership deed also provides that in the event of a partner being unable to pay off a debit balance the remaining partners will treat this as a trading loss.

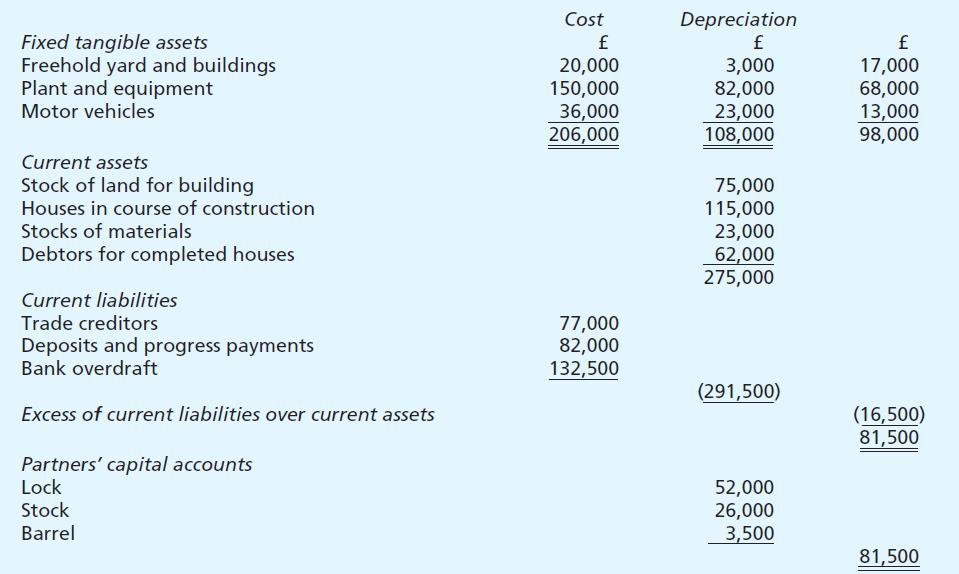

The latest partnership balance sheet was as follows:

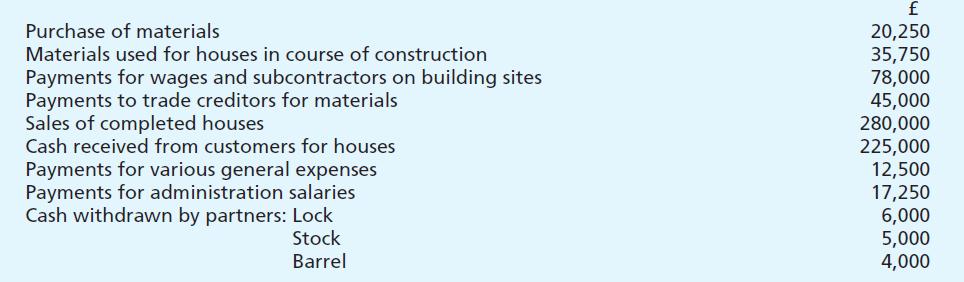

During the six months from the date of the latest balance sheet to the date of dissolution the following transactions have taken place:

All deposits and progress payments have been used for completed transactions.

Depreciation is normally provided each year at £600 on the freehold yard and buildings, at 10 per cent on cost for plant and equipment and 25 per cent on cost for motor vehicles.

The partners decide to dissolve the partnership on 1 February 20X7 and wish to take out the maximum cash possible, as items are sold. At this date there are no houses in course of construction and one-third of the stock of land had been used for building.

It is agreed that Barrel is insolvent and cannot bring any money into the partnership. The partners take over the partnership cars at an agreed figure of £2,000 each. All other vehicles were sold on 28 February 20X7 for £6,200. At the same date stocks of materials were sold for £7,000, and the stock of the land realised £72,500. On 30 April 20X7 the debtors paid in full and all the plant and equipment was sold for £50,000.

The freehold yard and buildings realised £100,000 on 1 June 20X7, on which date all remaining cash was distributed.

There are no costs of realisation or distribution.

Required:

(a) Prepare a partnership profit and loss account for the six months to 1 February 20X7, partners’ capital accounts for the same period and a balance sheet at 1 February 20X7.

(b) Show calculations of the amounts distributable to the partners.

(c) Prepare a realisation account and the capital accounts of the partners to the final distribution.

Step by Step Answer:

Frank Woods Business Accounting Volume 1

ISBN: 9780273681496

10th Edition

Authors: Frank Wood, Alan Sangster