LR, a trader, commenced business on 1 January 20X9, with a head office and one branch. All

Question:

LR, a trader, commenced business on 1 January 20X9, with a head office and one branch. All goods were purchased by the head office and goods sent to the branch were invoiced at a fixed selling price of 25 per cent above cost. All sales, both by the head office and the branch, were made at the fixed selling price.

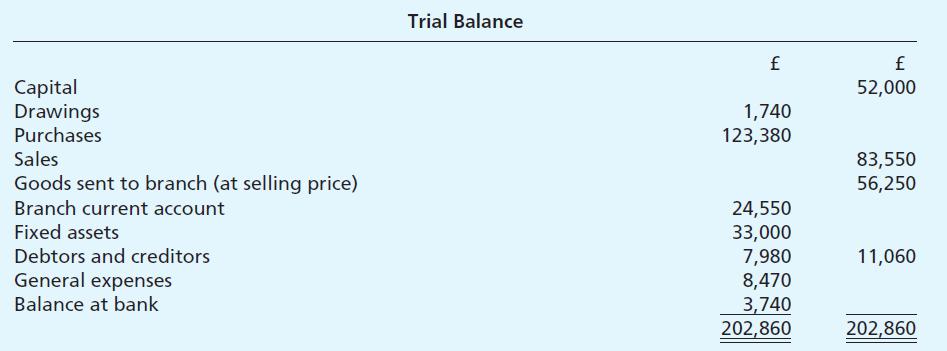

The following trial balance was extracted from the books at the head office at 31 December 20X9.

No entries had been made in the head office books for cash in transit from the branch to head office at 31 December 20X9, £1,000.

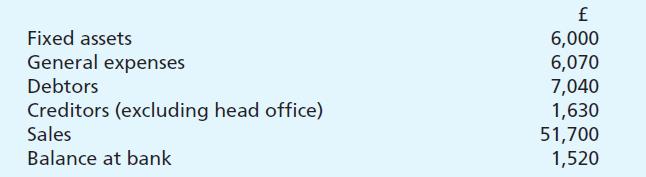

When the balances shown below were extracted from the branch books at 31 December 20X9, no entries had been made in the books of the branch for goods in transit on that date from head office to branch, £920 (selling price).

In addition to the balances which can be deduced from the information given above, the following balances appeared in the branch books on 31 December 20X9.

When stock was taken on 31 December 20X9, it was found that there was no shortage at the head office, but at the branch there were shortages amounting to £300, at selling price.

You are required to:

Prepare trading and profit and loss accounts

(a) For head office and

(b) For the branch, as they would have appeared if goods sent to the branch had been invoiced at cost, and a balance sheet of the whole business as on 31 December 20X9. Head office and branch stocks are to be valued at cost.

Ignore depreciation of fixed assets.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273693109

10th Edition

Authors: Frank Wood, Alan Sangster