The following figures appeared in W Ltds balance sheet at 31 March 20X2: During the year ended

Question:

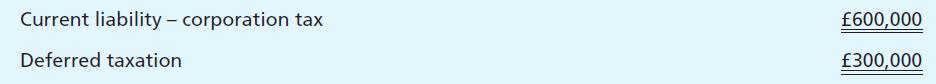

The following figures appeared in W Ltd’s balance sheet at 31 March 20X2:

During the year ended 31 March 20X3, W Ltd made a payment of £520,000 to the Collector of Taxes in settlement of the company’s corporation tax for the year ended 31 March 20X2. Dividend payments totalling £60,000 were made during the year ended 31 March 20X2 and a further dividend of £200,000 had been proposed at the year end.

Two dividend payments were made during the year ended 31 March 20X3. A payment of £200,000 was made for the final dividend for the year ended 31 March 20X2. An interim dividend of £40,000 was paid for the year ended 31 March 20X3. These payments were made in May 20X2 and September 20X2 respectively. The directors have provided a final dividend of £240,000 for the year ended 31 March 20X3.

W Ltd received a dividend of £12,000 from a UK quoted company. This was received in August 20X2.

W Ltd’s tax advisers believe that corporation tax of £740,000 will be charged on the company’s profits for the year ended 31 March 20X3. This amount is net of the tax relief of £104,000 which should be granted in respect of the exceptional loss which the company incurred during the year. It has been assumed that corporation tax will be charged at a rate of 35%. The basic rate of income tax was 25%.

It has been decided that the provision for deferred tax should be increased by £20,000. No provision is to be made in respect of timing differences of £400,000.

You are required:

(a) to prepare the note which will support the figure for the provision for corporation tax in W Ltd’s published profit and loss account for the year ended 31 March 20X3;

(b) to calculate the liability for corporation tax which will appear in W Ltd’s published balance sheet at 31 March 20X3;

(c) to prepare the deferred tax note which will support the figure for the liability which will appear in W Ltd’s published balance sheet at 31 March 20X3.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273693109

10th Edition

Authors: Frank Wood, Alan Sangster