The following information has been extracted from the books of account of Billinge plc as at 30

Question:

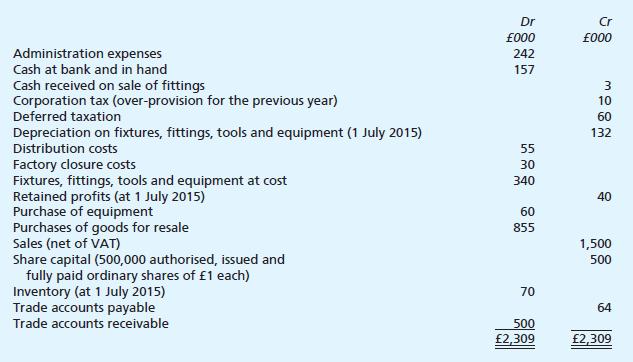

The following information has been extracted from the books of account of Billinge plc as at 30 June 2016:

Additional information:

1 The company was incorporated in 2010.

2 The inventory at 30 June 2016 (valued at the lower of cost or net realisable value) was estimated to be worth £100,000.

3 Fixtures, fittings, tools and equipment all related to administrative expenses. Depreciation is charged on them at a rate of 20% per annum on cost. A full year’s depreciation is charged in the year of acquisition, but no depreciation is charged in the year of disposal.

4 During the year to 30 June 2016, the company purchased £60,000 of equipment. It also sold some fittings (which had originally cost £20,000) for £3,000 and for which depreciation of £15,000 had been set aside.

5 The corporation tax based on the profits for the year at a rate of 35% is estimated to be £100,000.

A transfer of £40,000 is to be made to the deferred taxation account.

6 The company proposes to pay a dividend of 20p per ordinary share.

7 The standard rate of income tax is 30%.

Required:

In so far as the information permits, prepare Billinge plc’s statement of profit or loss for the year ending 30 June 2016, and a statement of financial position as at that date in accordance with the Companies Acts and appropriate accounting standards.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9781292085050

13th Edition

Authors: Frank Wood, Alan Sangster