The following trial balance of X Limited, a non-listed company, has been extracted from the books after

Question:

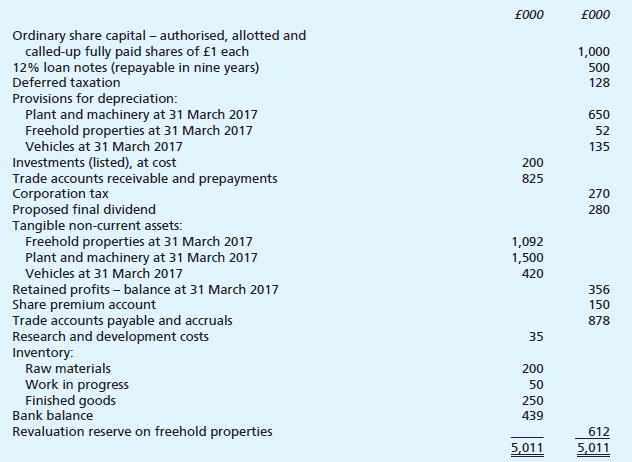

The following trial balance of X Limited, a non-listed company, has been extracted from the books after the preparation of the statement of profit or loss and statement of changes in equity for the year ending 31 March 2017.

You are also provided with the following information:

1 Investments

The listed investments consist of shares in W plc quoted on the Stock Exchange at £180,000 on 31 March 2017. This is not considered to be a permanent fall in the value of this asset.

2 Trade accounts receivable and prepayments

The company received notice, during April 2017, that one of its major customers, Z Limited, had gone into liquidation. The amount included in trade accounts receivable and prepayments is £225,000 and it is estimated that a dividend of 24p in the £ will be paid to unsecured creditors.

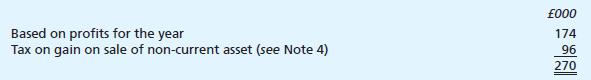

3 Taxation

(a) Corporation tax

The figure in the trial balance is made up as follows:

(b) Deferred taxation

A charge of £50,000 was made to profit or loss during the year ended 31 March 2017.

4 Tangible non-current assets

(a) In arriving at the profit for the year, depreciation of £242,000 was charged, made up of freehold properties £12,000, plant and machinery £150,000 and vehicles £80,000.

(b) During the year to 31 March 2017, new vehicles were purchased at a cost of £200,000.

(c) During March 2017, the directors sold one of the freehold properties which had originally cost £320,000 and which had a written-down value at the date of the sale of £280,000. A profit of £320,000 on the sale has already been dealt with in arriving at the profit for the year. The estimated corporation tax liability in respect of the gain is £96,000, as shown in Note 3. After this sale, the directors decided to have the remaining freehold properties revalued, for the first time, by Messrs V & Co, Chartered Surveyors and to include the revalued figure of £1,040,000 in the 2017 accounts.

5 Research and development costs

The company carries out research and development and accounts for it in accordance with the relevant accounting standard. The amount shown in the trial balance relates to development expenditure on a new product scheduled to be launched in April 2017. Management is confident that this new product will earn substantial profits for the company in the coming years.

6 Inventory

The replacement cost of the finished goods, if valued at 31 March 2017, would amount to £342,000.

You are required to prepare a statement of financial position at 31 March 2017 to conform to the requirements of the Companies Acts and relevant accounting standards in so far as the information given allows. The vertical format must be used.

The notes necessary to accompany this statement should also be prepared.

Workings should be shown, but comparative figures are not required.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9781292085050

13th Edition

Authors: Frank Wood, Alan Sangster