Wild started business on 1 April 20X2 selling one model of digital cameras on hire purchase. During

Question:

Wild started business on 1 April 20X2 selling one model of digital cameras on hire purchase. During the year to 31 March 20X3 he purchased 2,000 cameras at a uniform price of £90 and sold 1,900 cameras at a total selling price under hire purchase agreements of £150 per camera, payable by an initial deposit of £45 and 10 quarterly instalments of £10.50p.

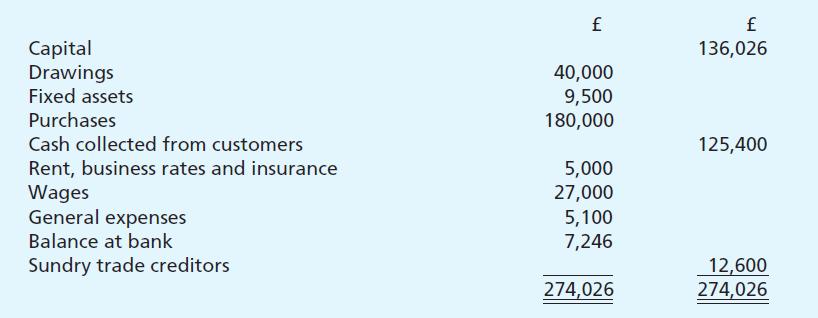

The following trial balance was extracted from Wild’s books as at 31 March 20X3.

The personal accounts of customers are memorandum records (i.e. they are not part of the double entry system).

Wild prepares his financial statements on the basis of taking credit for profit (including interest) in proportion to cash collected from customers.

Prepare Wild’s hire purchase trading account and a profit and loss account for the year ended

31 March 20X3 and a balance sheet as at that date. Ignore depreciation of fixed assets.

Step by Step Answer:

Frank Woods Business Accounting Volume 2

ISBN: 9780273693109

10th Edition

Authors: Frank Wood, Alan Sangster