Citizens Bank of Canada operates a credit card program that supports not-forprofit initiatives aimed at effecting positive

Question:

Citizens Bank of Canada operates a credit card program that supports not-forprofit initiatives aimed at effecting positive environmental and social change.

The Shared Interest VISA card has no annual fee, and each time it’s used 10 cents is donated to a pool of not-for-profits.

Suppose you work for another credit card issuer and your vice-president is considering launching a competing “enviro-social” credit card. You’re assigned to assess the market for such a card. Evidently a card of this type doesn’t appeal to everyone, so you decide to focus initially on just one market, “Young Technocrats,” for which you have some demographic information. Made up of recent graduates like yourself, this group is motivated to support issues like the environment, which they learned more about while at university. Moreover, they’ve postponed starting a family and can therefore afford to support causes they believe in with the high disposable income from their median $82,000 earnings.

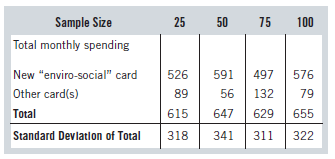

You test-market the “enviro-social” card to 25 Young Technocrats who already use another of your company’s cards. Some of them sign up for the new card, and in the next three months average $526 per month in spending on the new card and $89 on their other card(s). Young Technocrats as a whole, when previously using other cards, averaged $496 per month. These results look good for the new card, but the words of your vice-president at the end of the last meeting echo in your ears: “I don’t want cardholders to reduce the total money they put through our cards, and I don’t want test-market results spread more than 10% on either side of the mean, but I do want numbers on spending.” In order to get a narrow spread in the test-market results, you get funding to increase your sample from 25 people, monitor their spending for three months, and get the figures in the following table:

Your manager wants a report so that she can give the vice-president an update on progress. “He’s getting impatient, and he wants a look at some graphs, not vast tables of numbers,” she says. Give a clear statistical interpretation (based on 95% confidence intervals) of what you think the vice-president means by “[not] spread more than 10% on either side of the mean,” and write a brief report indicating whether the new card should be introduced. Criticize the method of successively increasing the sample size to get the confidence interval narrow enough. Choose the sample size by another method based on the results from the initial sample of size 25.

Step by Step Answer:

Business Statistics

ISBN: 9780133899122

3rd Canadian Edition

Authors: Norean D. Sharpe, Richard D. De Veaux, Paul F. Velleman, David Wright