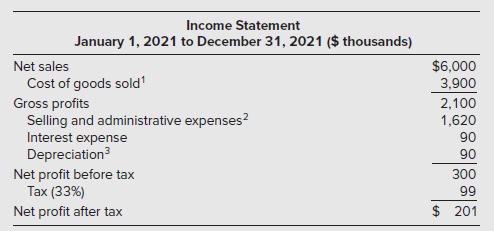

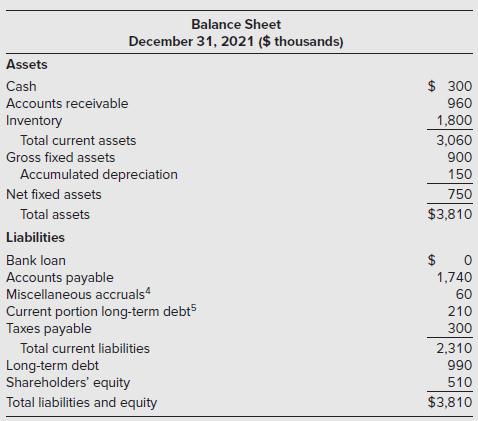

Continuing Problem 10, Westmark Industrials annual income statement and balance sheet for December 31, 2021, are shown

Question:

Continuing Problem 10, Westmark Industrial’s annual income statement and balance sheet for December 31, 2021, are shown next. Additional information about the company’s accounting methods and the treasurer’s expectations for the first quarter of 2022 appear in the footnotes.

a. Use this information and the information in Problem 10 to construct a pro forma income statement for the first quarter of 2022 and a proforma balance sheet for March 31, 2022. What is your estimated external financing need for March 31?

b. Does the March 31, 2022, estimated external financing equal your cash surplus (deficit) for this date from your cash budget in Problem 10? Should it?

c. Do your pro forma forecasts tell you more than your cash budget does about Westmark’s financial prospects?

d. What do your pro forma income statement and balance sheet tell you about Westmark’s need for external financing on February 28, 2022?

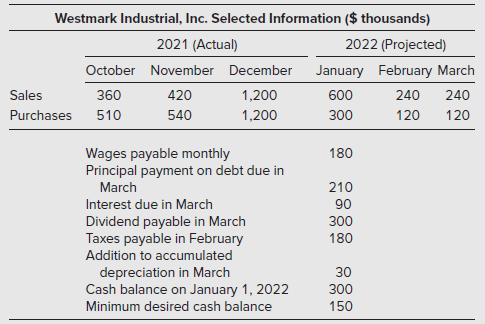

Data from Problem 10

The treasurer of Westmark Industrial, Inc., a wholesale distributor of household appliances, wants to estimate his company’s cash balances for the first three months of 2022. Using the following information, construct a monthly cash budget for Westmark for January through March 2022. Westmark’s sales are 20 percent for cash, with the rest on 30-day credit terms. Its purchases are all on 60-day credit terms. Does it appear from your results that the treasurer should be concerned about investing excess cash or looking for a bank loan?

Step by Step Answer:

ISE Analysis For Financial Management

ISBN: 9781265042639

13th International Edition

Authors: Robert C. Higgins Professor, Jennifer Koski