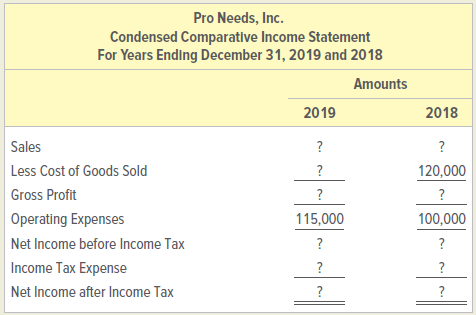

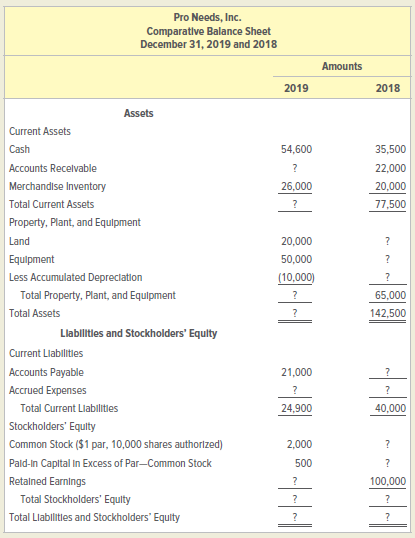

Pro Needs Inc.s condensed income statement and balance sheet for the years 2019 and 2018 follow. INSTRUCTIONS

Question:

INSTRUCTIONS

Using the following additional information, fill in the missing values:

1. Accounts Receivable increased 50 percent from 2018 to 2019.

2. There were no new purchases of land, property, or equipment in 2019.

3. Accounts Payable decreased 40 percent from 2018 to 2019.

4. No new shares of common stock were issued in 2019.

5. The company paid out cash dividends of $43,048 in 2019.

6. The inventory turnover ratio for 2019 was 6 times.

7. The asset turnover ratio in 2019 was 2.1 times and in 2018 was 2.0 times.

8. The earnings per share in 2019 was $44.624 and in 2018 was $26.00.

9. The effective income tax rate in both years was 20 percent.

Analyze: Assume that the management of Pro Needs Inc. had been given a directive by the board of directors to improve the company€™s current ratio in 2019. Did the company improve its standing in this regard from the prior year?

Inventory Turnover RatioThe inventory turnover ratio is a ratio of cost of goods sold to its average inventory. It is measured in times with respect to the cost of goods sold in a year normally. Inventory Turnover Ratio FormulaWhere,... Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Asset Turnover

Asset turnover is sales divided by total assets. Important for comparison over time and to other companies of the same industry. This is a standard business ratio.

Step by Step Answer:

College Accounting Chapters 1-30

ISBN: 978-1259631115

15th edition

Authors: John Price, M. David Haddock, Michael Farina