Honda Motor Company converted from U.S. GAAP to IFRS at the beginning of fiscal 2015. At that

Question:

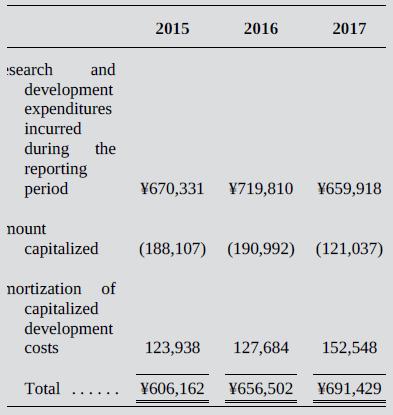

Honda Motor Company converted from U.S. GAAP to IFRS at the beginning of fiscal 2015. At that time, Honda began capitalizing new development costs. It also applied the capitalization rules of IAS 38 retroactively, recognizing development cost assets and amortization expenses as though it had capitalized these costs in earlier periods. Honda’s 2017 annual report included the following information on research and development costs incurred during the three fiscal years after the conversion to IFRS:

Required:

a. Suppose Honda had not switched to IFRS, but had instead continued to use U.S. GAAP in fiscal 2015. Would its R&D related expenses have been higher or lower than those that it actually reported in 2015 under IFRS? Explain your reasoning and compute the magnitude of the difference.

b. Suppose Honda had not switched to IFRS, but had instead continued reporting under U.S. GAAP through fiscal 2017. Would its R&D-related expenses have been higher or lower in fiscal 2017 than those that it actually reported? Again, explain your reasoning and compute the magnitude of the difference.

c. Under what circumstances would the decision to capitalize R&D expenditures decrease reported profitability compared with the full expensing system required by U.S. GAAP?

GAAPGenerally Accepted Accounting Principles (GAAP) is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC). While the SEC previously stated that it intends to move from U.S. GAAP to the International Financial Reporting Standards (IFRS), the...

Step by Step Answer:

International Accounting

ISBN: 978-1260466539

5th edition

Authors: Timothy Doupnik, Mark Finn, Giorgio Gotti, Hector Perera