Worldwide United Corporation (WUC), a U.S. taxpayer, manufactures and sells products through a network of foreign branches

Question:

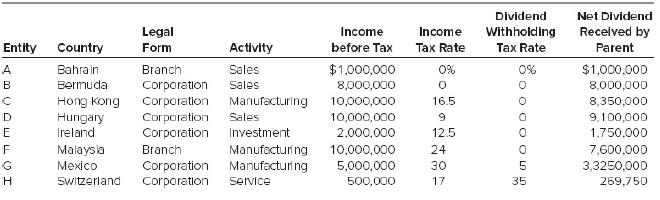

Worldwide United Corporation (WUC), a U.S. taxpayer, manufactures and sells products through a network of foreign branches and wholly-owned foreign subsidiaries. Relevant information for these entities for the current fiscal year appears in the following table:

Additional Information:

1. Entities C, F, and G manufacture products that are sold in their home countries as well as to sister entities within the WUC group.

2. Entity A purchases finished products from Entity F and then sells them throughout the Middle East. Only 5 percent of A’s income is generated from sales to customers in Bahrain; 95 percent of A’s income is from sales to foreign customers.

3. Entity B purchases finished products from Entity G and sells them throughout North and South America. Only 1 percent of B’s income is from sales to customers in Bermuda; 99 percent of B’s income is from sales to foreign customers.

4. Entity D purchases finished products from Entity C and then sells them throughout Europe. Only 40 percent of D’s income is generated from sales to customers in Hungary; 60 percent of D’s income is from sales to foreign customers.

5. Entity E makes passive investments in stocks and bonds in European financial markets. All of E’s income is derived from dividends and interest.

6. Entity H provides accounting and other management services to WUC’s other foreign operations. All of H’s income is derived from providing services to sister companies within the WUC group.

Required:

1. Determine the amount of U.S. taxable income for each entity (A, B, C, D, E, F, G, and H).

2. Calculate the foreign tax credit allowed in the United States, first by foreign tax credit basket and then in total.

3. Determine the net U.S. tax liability on foreign source income.

4. Determine any excess foreign tax credits and identify by basket.

StocksStocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

International Accounting

ISBN: 978-1260466539

5th edition

Authors: Timothy Doupnik, Mark Finn, Giorgio Gotti, Hector Perera