Charles is a 60% partner in CD Partnership, a calendar year partnership. For 2023, Charles received a

Question:

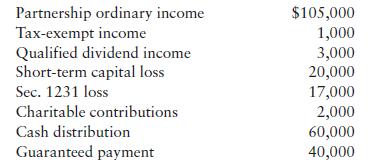

Charles is a 60% partner in CD Partnership, a calendar year partnership. For 2023, Charles received a Schedule K-1 that reported his share of partnership items as follows:

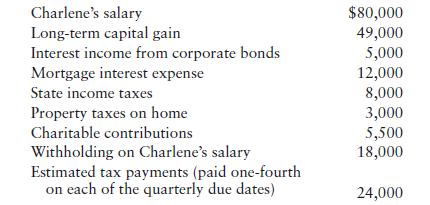

In addition, Charles and his wife, Charlene, had the following items relating to activities outside the partnership:

Charles and Charlene file a joint tax return. Calculate the following items for Charles and Charlene. (Ignore the deduction for one-half of self-employment tax.)

a. Adjusted gross income (AGI)

b. Taxable income

c. Tax liability

d. Taxes due or refund

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Pearsons Federal Taxation 2024 Individuals

ISBN: 9780138238100

37th Edition

Authors: Mitchell Franklin, Luke E. Richardson

Question Posted: