Dan M. and Cheryl A. Peters are married, file a joint return, and have no children in

Question:

Dan M. and Cheryl A. Peters are married, file a joint return, and have no children in 2023. Dan, age 45, is an independent contractor working in pharmaceutical sales and Cheryl, age 42, is a nurse at a local hospital. Dan’s SSN is 400-20-0000 and Cheryl’s SSN is 200-40-0000 and they reside at 2033 Palmetto Drive, Atlanta, GA 30304. Dan is paid according to commissions from sales, and he has no income tax or payroll tax withholdings. Dan operates his business from his home office. During 2023, Dan earned total commissions in his business of \($125,000.\) Cheryl earned a salary during 2023 of \($65,400\) with the following withholdings: \($9,000\) federal taxes, \($1,800\) state taxes, \($4,055\) OASDI (Social Security), and \($948\) Medicare taxes. During 2023, Dan and Cheryl had interest income from corporate bonds and bank accounts of \($1,450\) and qualified dividends from stocks of \($5,950.\) Dan also actively trades stocks and had the following results for 2023:

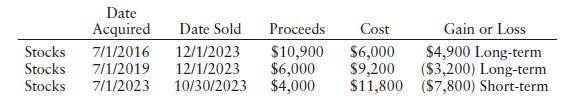

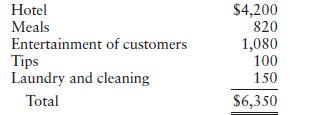

He had no capital loss carryovers from previous years. Basis for the stocks were reported to the IRS by the brokerage firm. Dan does a considerable amount of travel in connection with his business and uses his own car. During 2023, Dan drove his car a total of 38,000 miles, of which 32,000 were business related. He also had business-related parking fees and tolls during the year of \($280.\) Dan uses the mileage method for deducting auto expenses. Dan also had the following travel expenses while away from home during the year:

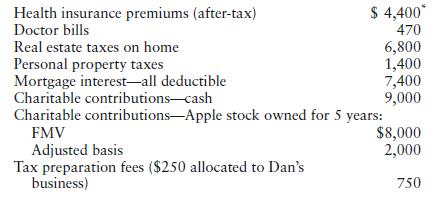

Dan uses the simplified method to deduct expenses for his office-in-home. His office measures 15 feet by 12 feet in size. Cheryl incurred several expenses in connection with her nursing job. She paid \($450\) in professional dues, \($200\) in professional journals, and \($350\) for uniforms. Dan and Cheryl had the following other expenditures during the year:

During 2023, Dan and Cheryl paid federal and state estimated tax payments on a quarterly basis. Federal estimated tax payments for the year amounted to \($20,000.\) State estimated payments for the year amounted to \($2,200.\) Compute Dan and Cheryl’s income tax liability for 2023. Disregard the alternative minimum tax but include the self employment tax.

Step by Step Answer:

Pearsons Federal Taxation 2024 Individuals

ISBN: 9780138238100

37th Edition

Authors: Mitchell Franklin, Luke E. Richardson