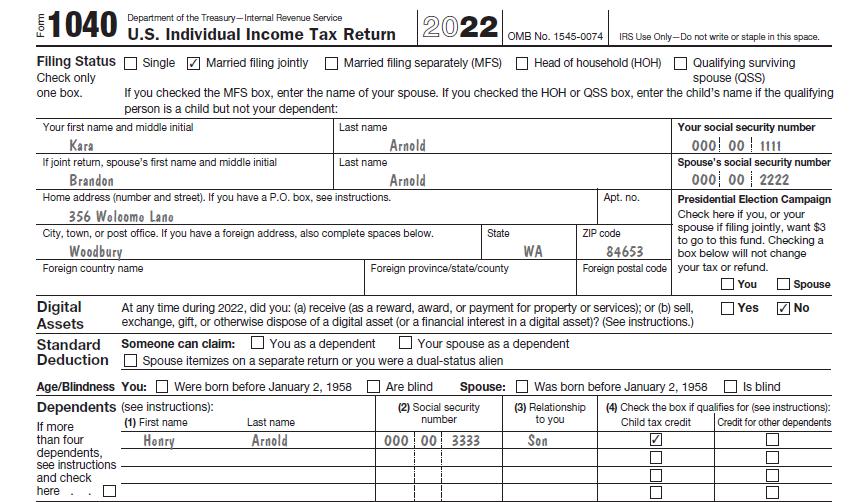

Kara and Brandon Arnold are married and file a joint return. They report their income on the

Question:

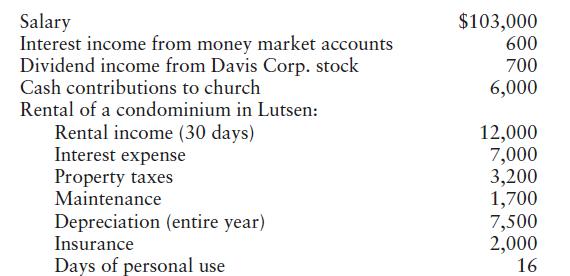

Kara and Brandon Arnold are married and file a joint return. They report their income on the cash method. During 2022, they report the following items:

a. In 2020, Brandon had loaned a friend \($3,000\) to help pay medical bills. During 2021, he discovers that his “friend” has skipped town.

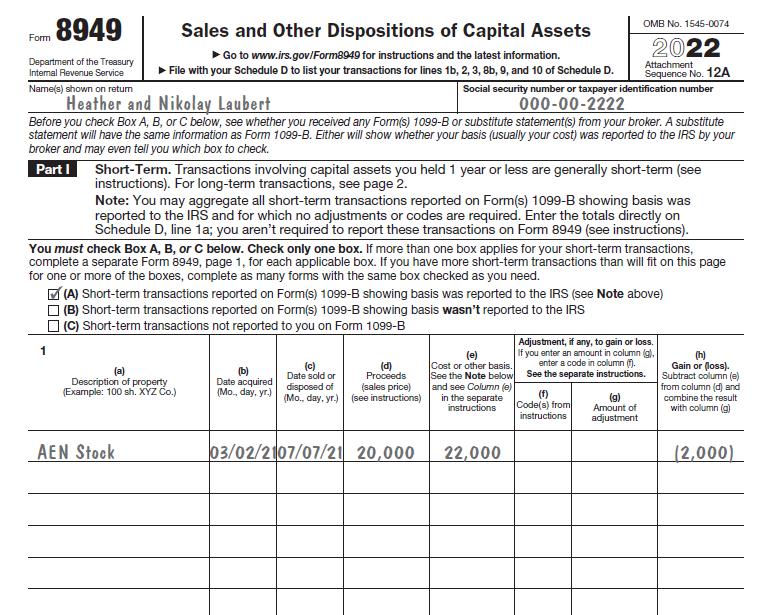

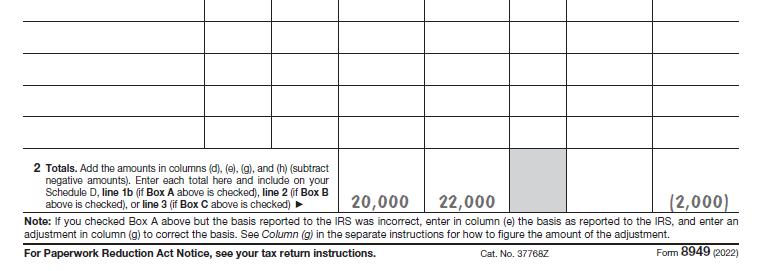

b. On June 20, 2022, Brandon sells Kim Corporation stock for \($16,000.\) He purchased the stock on December 12, 2015 for \($22,000\) .

c. On September 19, 2022, Kara discovers that the penny stock of Roberts, Inc. she purchased on January 2 of the prior year is completely worthless. She paid \($5,000\) for the stock.

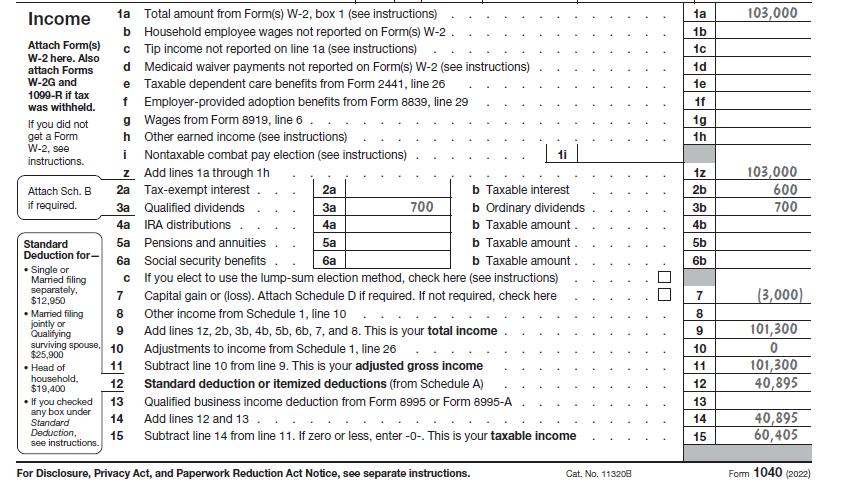

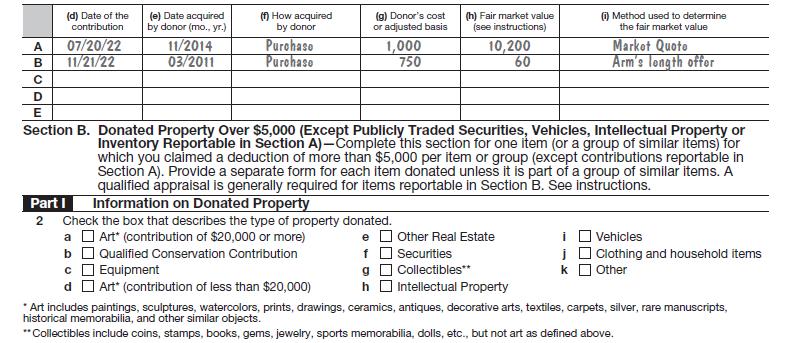

d. Instead of accepting \($60\) the utility store offers for their old dishwasher, they donate it to Goodwill on November 21, 2022. They purchased the dishwasher for \($750\) on March 30, 2011. The new dishwasher cost \($900\).

e. Kara and Brandon purchased a new residence for \($250,000.\) As part of the closing costs, they pay two points, or \($3,800,\) on the mortgage, which is interest rather than loan processing fees. This payment enables them to obtain a more favorable interest rate for the term of the loan. They also paid \($8,400\) in interest on their mortgage on their personal residence.

f. They pay \($4,100\) in property taxes on their residence and \($7,500\) in state income taxes.

g. On July 20, 2022, Kara and Brandon donate 1,000 shares of Anton, Inc. stock to the local community college. The value of the stock on that date is \($10,200.\) Anton, Inc. is a listed stock. They had purchased the stock on November 10, 2014, for \($1,000\).

h. \($7,000\) in federal income tax was withheld during the year.

Complete Kara and Brandon’s Form 1040, Schedules A, B, D, and E, Form 8283 and Form 8949. For purposes of this problem, disregard the alternative minimum tax and any credits.

Data From Form 1040

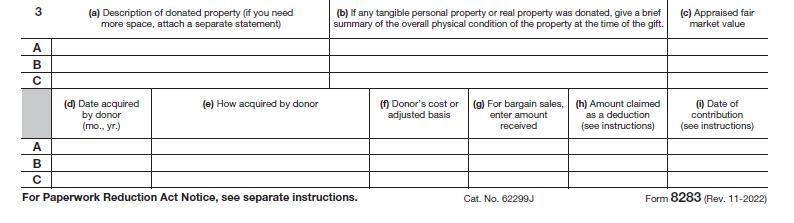

Data From Form 8283

Data From Form 8949

Step by Step Answer:

Pearsons Federal Taxation 2024 Individuals

ISBN: 9780138238100

37th Edition

Authors: Mitchell Franklin, Luke E. Richardson