Heather and Nikolay Laubert are married and file a joint income tax return. Nikolay is a mechanical

Question:

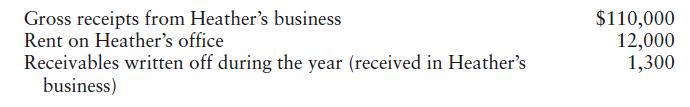

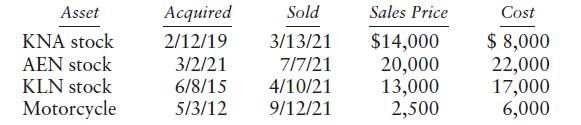

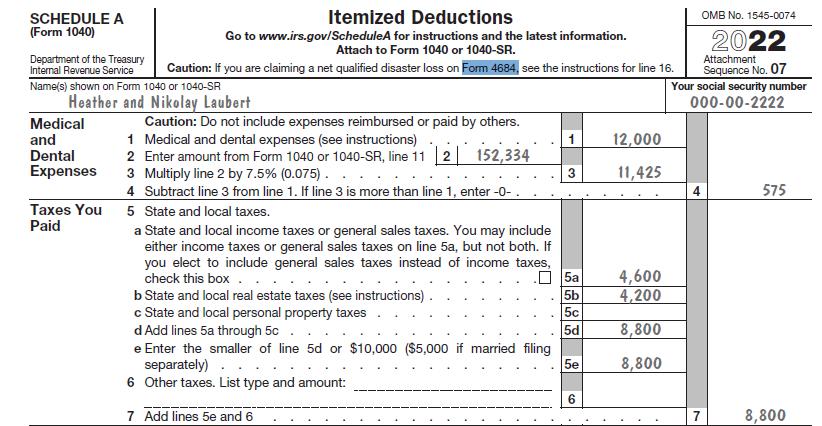

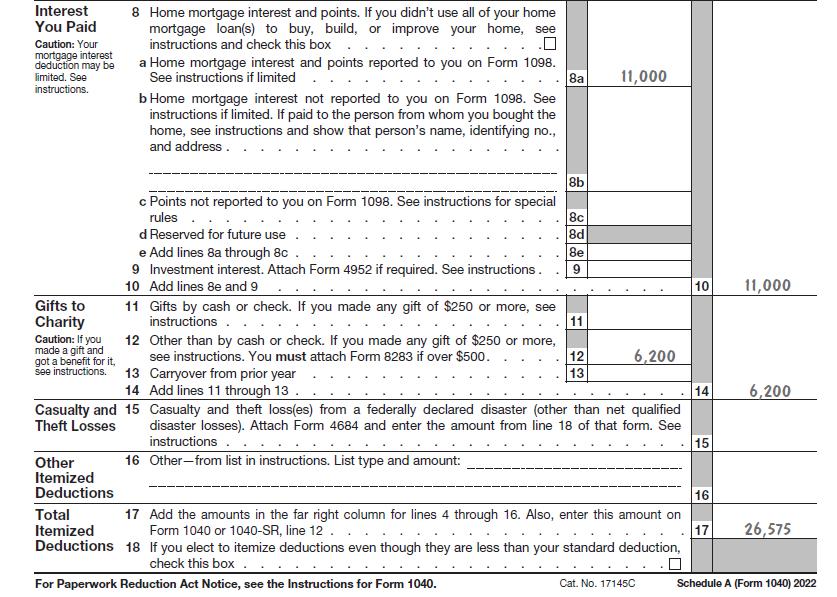

Heather and Nikolay Laubert are married and file a joint income tax return. Nikolay is a mechanical engineer, and Heather is a highly renowned speech therapist. Nikolay’s employer provides health care coverage for Heather and Nikolay. Heather is self-employed. They report all their income and expenses on the cash method. For 2022, they report the following items of income and expense:

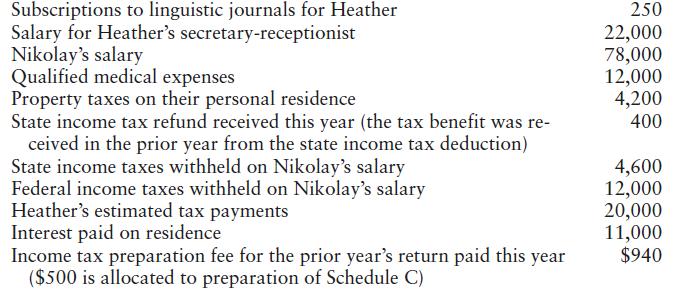

Heather and Nikolay sold the following assets:

Heather owned the KLN stock and sold it to her brother, Jacob. Heather and Nikolay used the motorcycle for personal recreation.

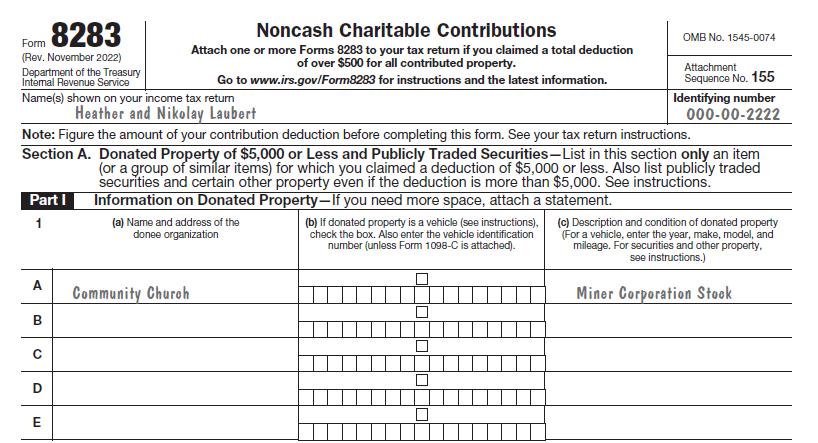

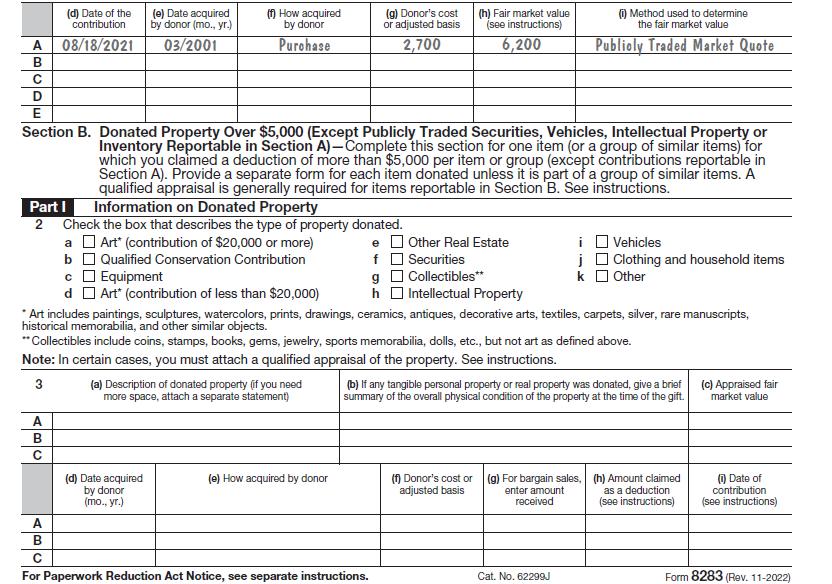

In addition to the items above, they donate Miner Corporation stock to their community church. The insurance company pays \($1,500\) for the snow blower, \($4,000\) for the shed, and \($500\) for the lawn mower. Complete Heather and Nikolay’s Form 1040, Schedules A, C, D, and SE, Form 4684, and Form 8283. For purposes of this problem, disregard the alternative minimum tax, any credits, and the qualified business income deduction.

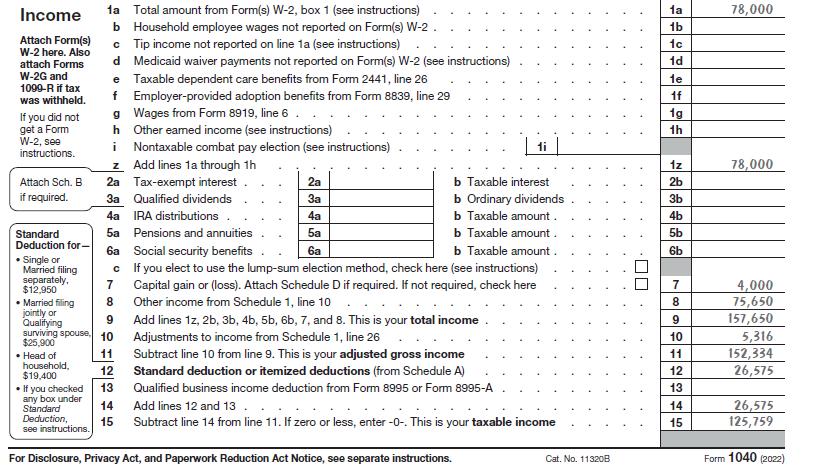

Data From Nikolay’s Form 1040

Data From Form 4684

Data From Form 8283

Step by Step Answer:

Pearsons Federal Taxation 2024 Individuals

ISBN: 9780138238100

37th Edition

Authors: Mitchell Franklin, Luke E. Richardson