Tim and Monica Nelson are married, file a joint return, and are your newest tax clients. They

Question:

Tim and Monica Nelson are married, file a joint return, and are your newest tax clients. They provide you with the following information relating to their 2023 tax return:

1. Tim works as a pediatrician for the county hospital. The W-2 form he received from the hospital shows wages of \($150,000\) and state income tax withheld of \($8,500.

2.\) Monica spends much of her time volunteering, but also works as a substitute teacher for the local schools. During the year, she spent 900 hours volunteering. When she doesn’t volunteer, she earns \($8.00\) per hour working as a substitute. The W-2 form she received from the school district shows total wages of \($3,888\) and state income tax withheld of \($85\).

3. On April 13, the couple paid \($250\) in state taxes with their 2022 state income tax return. The Nelsons’ state and local sales taxes in 2023 were \($5,500\).

4. On December 18, the Nelsons donated a small building to the Boy Scouts of America. They purchased the building three years ago for \($80,000.\) A professional appraiser determined the fair market value of the home was \($96,000\) on December 12.

5. Tim and Monica both received corrective eye surgery, at a total cost of \($3,000.\) They also paid \($1,900\) in health insurance premiums.

6. On June 1, the couple bought a car for \($30,000,\) paying \($18,000\) down and borrowing \($12,000.\) They paid \($750\) total interest on the loan in 2023.

7. On June 10, the Nelsons took out a home equity loan of \($20,000\) to expand their home. They paid a total of \($850\) interest with their monthly payments on the loan.

8. The Nelsons paid a total of \($2,300\) interest on their original home loan.

9. They sold stock in Cabinets, Inc. for \($5,200,\) which they purchased for \($7,900\) in March of the current year. They also sold stock in The Outdoor Corporation for \($12,500,\) which they purchased several years ago for \($8,600\).

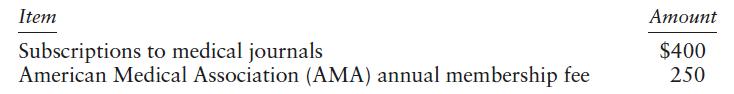

10. Tim incurred the following expenses related to his profession, none of which were reimbursed by his employer:

11. During the year, the couple paid their former tax advisor \($700\) to prepare their prior year tax return.

12. The Nelsons do not have children, and they do not provide significant financial support to any family members.

Required:

Compute the Nelsons’ taxable income for 2023.

Step by Step Answer:

Pearsons Federal Taxation 2024 Individuals

ISBN: 9780138238100

37th Edition

Authors: Mitchell Franklin, Luke E. Richardson