Mammouth Mutual Fund of New York has $5 million to invest in certificates of deposit (CDs) for

Question:

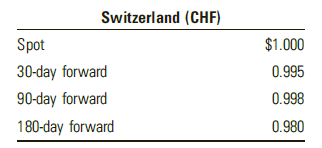

a. If the Zurich Bank CD is purchased and held to maturity, determine the net gain (loss) in U.S. dollars relative to the PNB CD, assuming that the exchange rate in 180 days equals today€™s spot rate.

b. Suppose the Swiss CHF declines in value by 5 percent relative to the U.S. dollar over the next 180 days. Determine the net gain (loss) of the Zurich Bank CD in U.S. dollars relative to the PNB CD for an uncovered position.

c. Determine the net gain (loss) from a covered position.

d. What other factor or factors should be considered in the decision to purchase the Zurich Bank CD?

The value of one currency for the purpose of conversion to another. Exchange Rate means on any day, for purposes of determining the Dollar Equivalent of any currency other than Dollars, the rate at which such currency may be exchanged into Dollars...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Contemporary Financial Management

ISBN: 978-1337090582

14th edition

Authors: R. Charles Moyer, James R. McGuigan, Ramesh P. Rao

Question Posted: