A decides to convert his business into a limited company with effect from 1st January, 2016 and

Question:

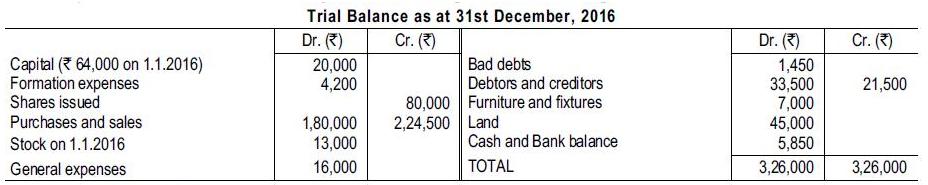

A decides to convert his business into a limited company with effect from 1st January, 2016 and issues for cash 10,000 equity shares of ₹ 10 each at par to his friends and customers. From the proceeds vendor was paid ₹ 80,000 plus the amount of reimbursement of his outlay in the formation of the company amounting to ₹ 4,200, the balance due being settled by the allotment of the remaining 2,000 shares at par on new book opened. Stock on 31st December, 2016, ₹ 25,500. The furniture and fixtures are revalued at ₹ 10,500 and debtors at ₹ 12,000, out of which ₹ 1,100 proved to be bad. A is to get a salary of 12,000 p.a. commencing from the date of incorporation, i.e., March 1st, 2016 and interest @ 6% p.a. to that date on the principal amount due to him. Profit prior to incorporation to be calculated on time basis excluding A's salry and interest to be charged against such profit. Prepare the Trading and Profit and Loss Account for the year ended 31st December, 2016 and the balance sheet as at that date, giving effect to all necessary adjustments, none of which has been entered in the books, except that A's Capital has been debited with each proceeds of the share-issue paid to him, formation expenses and ₹ 4,000 on account of salary. No further amounts of salary and interest due to him have been paid. Ignore income-tax.

Stock on 31st December, 2016, ₹ 25,500. The furniture and fixtures are revalued at ₹ 10,500 and debtors at ₹ 12,000, out of which ₹ 1,100 proved to be bad. A is to get a salary of 12,000 p.a. commencing from the date of incorporation, i.e., March 1st, 2016 and interest @ 6% p.a. to that date on the principal amount due to him. Profit prior to incorporation to be calculated on time basis excluding A's salry and interest to be charged against such profit. Prepare the Trading and Profit and Loss Account for the year ended 31st December, 2016 and the balance sheet as at that date, giving effect to all necessary adjustments, none of which has been entered in the books, except that A's Capital has been debited with each proceeds of the share-issue paid to him, formation expenses and ₹ 4,000 on account of salary. No further amounts of salary and interest due to him have been paid. Ignore income-tax.

Step by Step Answer:

Corporate Accounting As Per The Companies Act 2013 Including Rules 2014 And 2015

ISBN: 9789352605569

2nd Edition

Authors: M Hanif, A Mukherjee