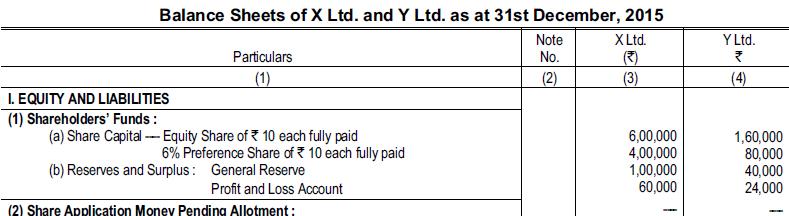

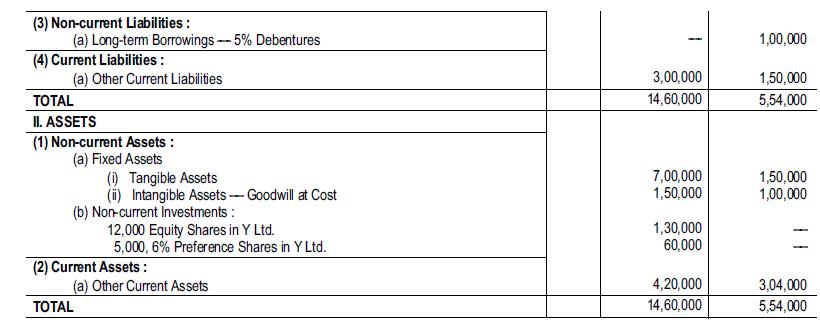

The Balance Sheets of X Ltd. and Y Ltd. as at 31st December, 2015 of X Ltd.

Question:

The Balance Sheets of X Ltd. and Y Ltd. as at 31st December, 2015 of X Ltd. are given below:

At the date of acquisition of the shares in Y Ltd. by X Ltd. the General Reserve and Profit and Loss Account of Y Ltd. stood at ₹ 30,000 and ₹ 10,000 respectively. Y Ltd. paid preference dividends up to 30th June, 2015 and equity dividends up to 31st December, 2014. The equity dividend of ₹ 6,000 received by X Ltd., since the acquisition of the shares out of the balance of ₹ 10,000 brought forward at the time of acquisition has been credited to the Investment Account by X Ltd. Debenture interest has been paid up to 31st December, 2015. It was decided that the value of the plant and machinery of Y Ltd,. standing in the books at ₹ 50,000 should be revalued at ₹ 40,000. No adjustment has been made for this in the books. Depreciation of plant and machinery is written-off at 20% p.a. The stock of X Ltd. includes goods worth ₹ 7,500 purchased from Y Ltd. the cost of which to Y Ltd. is ₹ 5,000. The stock of Y Ltd. includes goods worth ₹ 20,000 purchased from X Ltd. X Ltd. invoices its goods by adding 25% to cost. You are required to prepare a Consolidated Balance Sheet of X Ltd. and its subsidiary as at 31st December, 2015.

Step by Step Answer:

Corporate Accounting As Per The Companies Act 2013 Including Rules 2014 And 2015

ISBN: 9789352605569

2nd Edition

Authors: M Hanif, A Mukherjee