The following information relates to the business of Progressive Ltd for the year ended 31st December, 2015

Question:

The following information relates to the business of Progressive Ltd for the year ended 31st December, 2015 :

(i) The trading results disclosed an operating profit of ₹ 2,50,000.

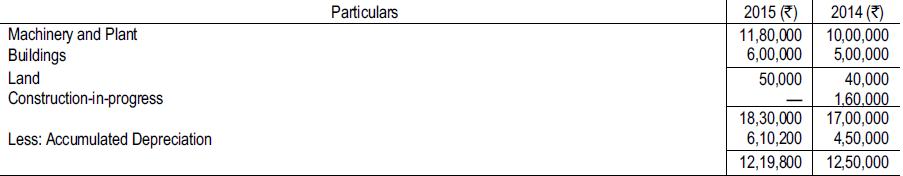

(ii) The position of some Fixed Assets at the year end was as follows:

(iii) Construction-in-progress at 31st December, 2014 included ₹50,000 for an addition to the Company’s main building and the balance for machinery and plant. Upon completion of the addition in June 2015, the construction costs were transferred to the appropriate accounts.

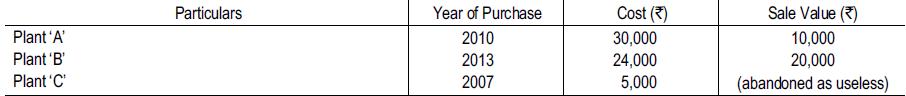

(iv) particulars of disposal of plants during 2015:

Depreciation is always provided annually on a straight line basis @ 10% (other than on land).

(v) Building Account included a credit entry of ₹7,000 representing a refund of an amount billed twice in error during April, 2015.

(vi) A debit of ₹6,000 appeared in the Accumulated Depreciation Account during the year representing the cost of two electric motors. These motors replaced two similar motors purchased 12 years ago for approximately the same cost and were fully depreciated and written off.

(vii) Cost of Building included ₹5,000 architect’s fees which were paid by the issue of 500 Equity Shares of the company.

(viii) The following further information is given :

(1) Patent rights purchased for ₹10,000.

(2) Nominal value of preference shares for ₹60,000 redeemed at a premium of 10%.

(3) Debentures converted into preference shares ₹25,000.

(4) Amortisation of patent rights ₹2,000.

(5) Non-operating income ₹35,000 Non-operating expenses ₹22,000.

(6) Issue of new Euity Shares ₹50,000.

(7) Capitalisation of reserves by issue of bonus shares ₹30,000.

(8) Working capital on 31st December, 2015 was ₹2,62,200 more than the same on 31st Deember 2014. You are required to prepare a Fund Flow Statement for the year ended 31st December, 2015.

Step by Step Answer:

Corporate Accounting As Per The Companies Act 2013 Including Rules 2014 And 2015

ISBN: 9789352605569

2nd Edition

Authors: M Hanif, A Mukherjee