A company expects to receive $180,000 in three months time and wants to lock into the current

Question:

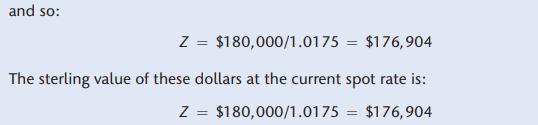

A company expects to receive $180,000 in three months’ time and wants to lock into the current exchange rate of $1.65/£. It fears that the pound will appreciate against the dollar. To set up a money market hedge, the company sets up a dollar debt by borrowing dollars now. It converts the dollars to sterling at the current spot rate and deposits the sterling proceeds on the sterling money market. When the dollar loan matures, it is paid off by the future dollar receipt. If the annual dollar borrowing rate is 7 per cent, the three-month dollar borrowing rate is 1.75 per cent, 7% × 3/12: i.e. if Z is the amount of dollars to be borrowed now, then:

![]()

If the annual sterling deposit rate is 6 per cent, the three-month sterling deposit rate is 1.5 per cent and the value of these dollars in three months’ time will be:

![]()

The three-month sterling value of the money market hedge can be compared with the sterling receipt from a forward exchange contract in order to determine which hedging method is the most financially beneficial. The financial benefit of different hedging methods must always be compared from the same point in time.

Step by Step Answer:

Corporate Finance Principles And Practice

ISBN: 9781292450940

9th Edition

Authors: Denzil Watson, Antony Head