A UK airline is buying a new aeroplane. Payment will be in US dollars, so the airline

Question:

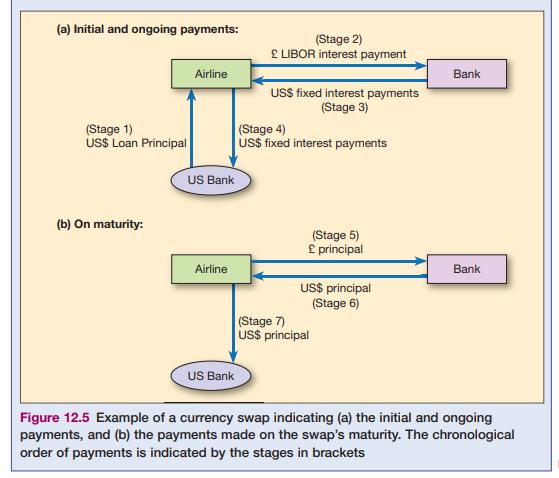

A UK airline is buying a new aeroplane. Payment will be in US dollars, so the airline will finance its purchase with a fixed interest dollar loan from a US bank (stage 1 in Figure 12.5). As the airline’s income is predominantly in sterling, it has approached another bank to arrange a currency swap. Within this swap will be a par exchange rate which is used to convert dollar cash flows into pounds. It will be used to convert the dollar loan into a sterling principal on which to base the sterling LIBOR payments the

airline will make to the bank (stage 2), in return for the bank paying to the airline the dollar interest payments on the airline’s dollar loan (stage 3). These dollar interest payments will then be paid to the US bank by the airline (stage 4). When the swap matures the airline will pay the sterling principal to the bank (stage 5) and in return will receive a dollar payment (stage 6) with which to pay off its maturing dollar loan (stage 7). Looking at the swap as a whole, we can see that the airline has paid off a sterling loan principal and sterling LIBOR-determined interest payments, hence avoiding exchange rate risk.

Determine the cash flow of the entire project associated with the debt financing.

- Assume all values are in today’s money (do not inflate).

- 10% down payment is paid at year 0 (10% of the $35M)

- 9% of the unpaid principal ($35M - $3.5M down payment) is paid every year to Boeing from year 1 to year 10.

- Unpaid principal ($35M - $3.5M down payment) is paid as lump sum at year 10.

Step by Step Answer:

Corporate Finance Principles And Practice

ISBN: 9781292450940

9th Edition

Authors: Denzil Watson, Antony Head