Altshuler, Inc., generated the following forecast for a capital budgeting project: The CEO, David Altshuler, estimates inflation

Question:

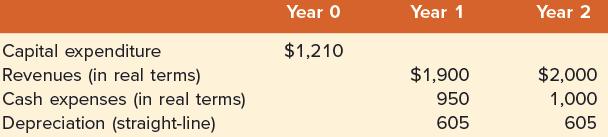

Altshuler, Inc., generated the following forecast for a capital budgeting project:

The CEO, David Altshuler, estimates inflation to be 10 percent per year over the next two years.

In addition, he believes that the cash flows of the project should be discounted at the nominal rate of 15.5 percent. His firm’s tax rate is 21 percent.

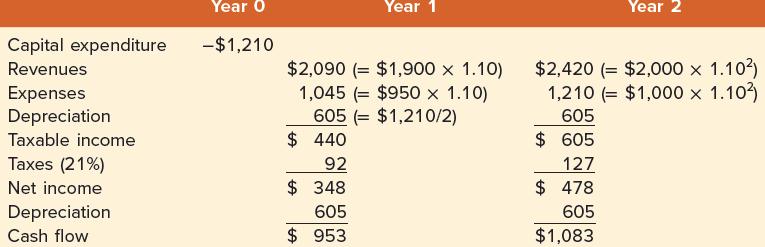

David forecasts all cash flows in nominal terms, leading to the following table and NPV calculation:

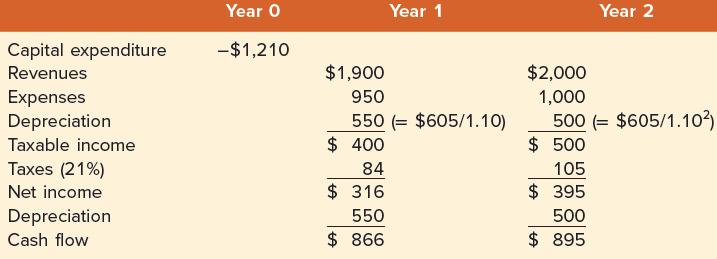

The firm’s CFO, Mariassunta Giannetti, prefers working in real terms. She first calculates the real rate to be 5 percent ( = 1.155 / 1.10 − 1 ) . Next, she generates the following table in real quantities:

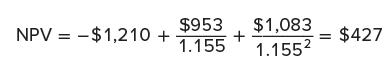

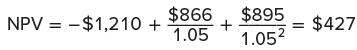

Mariassunta calculates the value of the project as:

In explaining her calculations to David, Mariassunta points out these facts:

1. The capital expenditure occurs at Year 0, so its nominal value and its real value are equal.

2. Because yearly depreciation of $605 is a nominal quantity, one converts it to a real quantity by discounting at the inflation rate of 10 percent.

It is no coincidence that both David and Mariassunta arrive at the same NPV number. Both methods must always generate the same NPV.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe