The Knight Corporation plans to be in business for one more year. It forecasts a cash flow

Question:

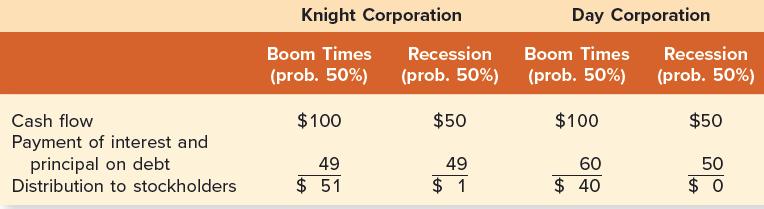

The Knight Corporation plans to be in business for one more year. It forecasts a cash flow of either $100 or $50 in the coming year, each occurring with 50 percent probability. The firm has no other assets. Previously issued debt requires payments of $49 of interest and principal. The Day Corporation has identical cash flow prospects but has $60 of interest and principal obligations. The cash flows of these two firms can be represented as follows:

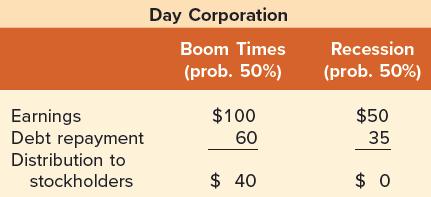

For Knight Corporation in both boom times and recession and for Day Corporation in boom times, cash flow exceeds interest and principal payments. In these situations, the bondholders are paid in full and the stockholders receive any residual. However, the most interesting of the four columns involves Day Corporation in a recession. Here the bondholders are owed $60, but the firm has only $50 in cash. Because we assume that the firm has no other assets, the bondholders cannot be satisfied in full. Bankruptcy occurs, implying that the bondholders will receive all of the firm’s cash and the stockholders will receive nothing. Importantly, the stockholders do not have to come up with the additional $10 ( = $60 − 50 ) . Corporations have limited liability in the United States and most other countries, implying that bondholders cannot sue the stockholders for the extra $10.1 Let’s compare the two companies in recession. The bondholders of Knight receive $49 and the stockholders receive $1, for a total of $50. The bondholders of Day receive $50 and the stockholders receive $0, also for a total of $50. There is an important point here. While Day goes bankrupt but Knight does not, the investors of both firms receive $50. In other words, bankruptcy does not reduce the firm’s cash flows. One often hears that bankruptcy causes a reduction in value or cash flow. But in our example, it is a recession causing the reduction, not bankruptcy. However, we have left something out. Day’s example is not realistic because it ignores an important cash flow. A more realistic set of numbers might be:

Why do the bondholders receive only $35 in a recession? If cash flow is only $50, bondholders will be informed that they will not be paid in full. These bondholders are likely to hire lawyers to negotiate or even to sue the company. The firm is also likely to hire lawyers to defend itself.

Further costs will be incurred if the case gets to a bankruptcy court. These fees are always paid before the bondholders get paid. In this example, we are assuming that bankruptcy costs total $15 ( = $50 − 35 ) .

Let’s compare the example with bankruptcy costs to the example without these costs.

Because of its greater leverage, Day Corporation faces the possibility of bankruptcy, while Knight Corporation does not. Nevertheless, as we saw earlier, total cash flow to investors is the same for both firms in a world without bankruptcy costs. However, once we introduce bankruptcy costs, total cash flow to investors becomes lower for the bankrupt company, Day. In a recession, Knight’s bondholders receive $49 and the stockholders receive $1, for a total of $50. In a recession, Day’s bondholders receive $35 and the stockholders receive $0, for a total of only $35. We can conclude the following:

Leverage increases the likelihood of bankruptcy. However, bankruptcy does not, by itself, lower the cash flows to investors. Rather, it is the costs associated with bankruptcy that lower cash flows.

Our pie example can provide an explanation. In a world without bankruptcy costs, the bondholders and the stockholders share the entire pie. However, bankruptcy costs eat up some of the pie in the real world, leaving less for the stockholders and bondholders.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe