Lionel Corporation manufactures pharmaceutical products sold through a network of sales agents in the United States and

Question:

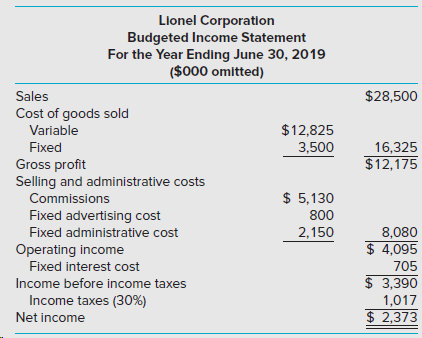

Since the completion of the income statement, Lionel has learned that its sales agents are requiring a 5% increase in their commission rate (to 23%) for the upcoming year. As a result, Lionel€™s president has decided to investigate the possibility of hiring its own sales staff in place of the network of sales agents and has asked Alan Chen, Lionel€™s controller, to gather information on the costs associated with this change.

Alan estimates that Lionel must hire eight salespeople to cover the current market area, at an average annual payroll cost for each employee of $80,000, including fringe benefits expense. Travel and entertainment expenses is expected to total $600,000 for the year, and the annual cost of hiring a sales manager and sales secretary will be $150,000. In addition to their salaries, the eight salespeople will each earn commissions at the rate of 10% of sales. The president believes that Lionel also should increase its advertising budget by $500,000 if the eight salespeople are hired.

Required

1. Determine Lionel€™s breakeven point in sales dollars for the fiscal year ending June 30, 2019, if the company hires its own sales force and increases its advertising costs. Prove this by constructing a contribution income statement.

2. If Lionel continues to sell through its network of sales agents and pays the higher commission rate, determine the estimated volume in sales dollars that would be required to generate the operating profit as projected in the budgeted income statement.

3. Describe the general assumptions underlying breakeven analysis that may limit its usefulness.

4. What is the indifference point in sales for the firm to either accept the agents€™ demand or adopt the proposed change? Which plan is better for the firm? Why?

5. What are the ethical issues, if any, that Alan should consider?

Step by Step Answer:

Cost Management A Strategic Emphasis

ISBN: 9781259917028

8th Edition

Authors: Edward Blocher, David F. Stout, Paul Juras, Steven Smith