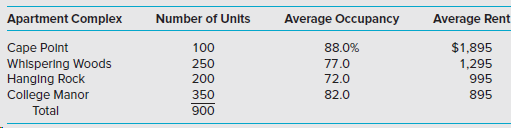

Wical Rental Management Services manages four apartment buildings, each with a different owner. Wicals CEO has observed

Question:

For the current year, Wical must choose between the number of units in each complex, the average occupancy, or the total annual rental revenue in each complex to allocate the management fee.

Required

1. How much of the management fee would be charged to Cape Point under each of the three allocation bases (number of units, average occupancy, and total annual rental revenue, respectively)?

a. $35,765; $85,804; $106,278

b. $48,972; $121,585; $90,050

c. $1,847,655; $2,440,263; $1,954,781

d. $58,489; $117,854; $86,710

2. Explain which allocation base you would choose and why. What ethical issues, if any, are involved in the choice of allocation base?

Step by Step Answer:

Cost Management A Strategic Emphasis

ISBN: 9781259917028

8th Edition

Authors: Edward Blocher, David F. Stout, Paul Juras, Steven Smith