Consider a five- year bond with a coupon rate of 12 percent and a face value of

Question:

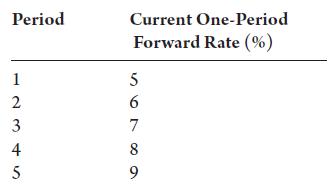

Consider a five- year bond with a coupon rate of 12 percent and a face value of $1,000. Given the following hypothetical interest rates and assuming the pure expectations theory is correct, calculate the bond’s expected price in two years.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Debt Markets And Investments

ISBN: 9780190877439

1st Edition

Authors: H. Kent Baker, Greg Filbeck, Andrew C. Spieler

Question Posted: