Assume the Black-Scholes framework. Three months ago, Tyler bought 100 units of an at-the-money European call option

Question:

Assume the Black-Scholes framework. Three months ago, Tyler bought 100 units of an at-the-money European call option on a nondividend-paying stock.

He immediately delta-hedged his position with appropriate units of an otherwise identical European put option, but has not ever re-balanced his portfolio. He now decides to close out all positions.

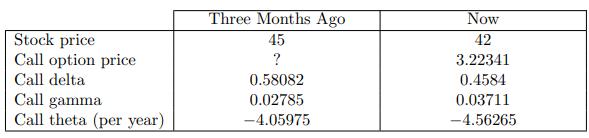

You are given:

(i) The stock’s volatility is 36%.

(ii)

Calculate Tyler’s three-month holding profit.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: