Assume the Black-Scholes framework. Three months ago, you sold 1,000 units of a 1-year European put option

Question:

Assume the Black-Scholes framework. Three months ago, you sold 1,000 units of a 1-year European put option on a nondividend-paying stock. You immediately delta-hedged your position with appropriate number of shares of the stock, but have not ever re-balanced his portfolio. You now decide to close out all positions.

You are given:

(i) The stock’s volatility is 30%.

(ii) The put option is at-the-money currently.

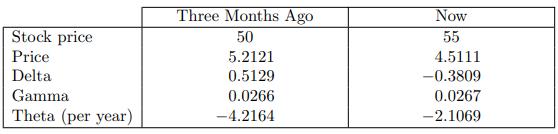

(iii) Your careless secretary has provided you with the following values. However, she is not sure about whether these values are for the put option you sold or for a call option with the same strike, time to maturity, and underlying stock:

Calculate your three-month holding profit.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: