For two European call options, Call-I and Call-II, on a stock, you are given: Suppose you just

Question:

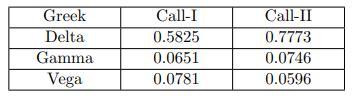

For two European call options, Call-I and Call-II, on a stock, you are given:

Suppose you just sold 1,000 units of Call-I. You buy or sell appropriate units of the stock and Call-II in order to both delta-hedge and vega-hedge your position in Call-I.

Calculate the gamma of your hedged portfolio.

Transcribed Image Text:

Greek Delta Gamma Vega Call-I 0.5825 0.0651 0.0781 Call-II 0.7773 0.0746 0.0596

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

To calculate the gamma of your hedged portfolio we need to consider the gamma of both the stock and ...View the full answer

Answered By

Shaira grace

I have experience of more than ten years in handing academic tasks and assisting students to handle academic challenges. My level of education and expertise allows me communicate eloquently with clients and therefore understanding their nature and solving it successfully.

5.00+

4+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

For two European call options, Call-I and Call-II, on a stock, you are given: Suppose you just sold 1000 units of Call-I. Determine the numbers of units of Call-II and stock you should buy or sell in...

-

Assume the Black-Scholes framework. You are given: (i) The current price of a nondividend-paying stock is 50. (ii) The stocks volatility is 30%. (iii) The continuously compounded risk-free interest...

-

The Goodson Company manufactures four different products that it ships to customers throughout Canada. Delivery times are not a driving factor in the decision as to which type of carrier to use...

-

Which of the following 22 items does a company include in the cost of property, plant, and equipment? 1. Contract price 2. List price 3. Freight costs 4. Discounts taken 5. Discounts not taken 6....

-

What are operating current assets? What are operating current liabilities? How much net operating working capital and total net operating capital does Computrons have? Donna Jamison, a graduate of...

-

Explain several implications of IFRS on financial reporting by health care organizations.

-

1. How would you describe the founding team of Fenton, Hoffer, and Le Tuan? Is it a balanced team? What does each member bring to the business? Can you see gaps in their skills and capabilities that...

-

Share any experience you have with a database accessed for work or pleasure. What database management system was used for the database? Did you like the database? Why or why not? Or, share a link to...

-

Assume the Black-Scholes framework. You are given: (i) The current price of a stock is 60. (ii) The stock pays no dividends. (iii) The stocks volatility is 30%. (iv) The continuously compounded...

-

Assume the Black-Scholes framework. Yesterday, you sold a European call option on a nondividendpaying stock. You immediately delta-hedged the commitment with shares of the stock. Today, you decide to...

-

The beams AB and BC are supported by the cable that has a parabolic shape. Determine the tension in the cable at points D, F, and E, and the force in each of the equally spaced hangers. 3'm 9 m A B 5...

-

The figure shows a graph of two pulses traveling toward each other at t = 0 s. Each pulse has a constant speed of 1 cm/s. When t = 2.5 s, what is the height of the resultant pulse at x = 5 cm? +2 cm...

-

A 2.0-kg block on a rough horizontal surface moves toward a spring of force constant k = 2000 N/m. The speed of the block at the moment it collides with the spring is 6.0 m/s. If a constant friction...

-

An object moves in the positive direction of the x axis with a negative acceleration of -5.0 m/s. At t = 6.0 s, the object changes direction, and at t = 10.0 s, the object is in the position x = 650...

-

In the opposite circuit (R1 =6) (R2 = 42). And the reading of voltmeter (3v), What is the amount of total voltage Vemf for battery? R R

-

The figure shows a graph of two pulses traveling toward each other at t=0 s. Each pulse has a constant speed of 1 cm/s. When t = 5 s, what is the height of the resultant pulse at x = 3 cm? +2 cm +1...

-

The following information pertains to kevin, Inc. Cash .................. $42,000 Accounts receivable ............$130,000 Inventory ................ $95,000 Plant assets (net) .............$340,000...

-

Why is inventory management important for merchandising and manufacturing firms and what are the main tradeoffs for firms in managing their inventory?

-

RLW-II Enterprises estimated that indirect manufacturing costs for the year would be $60 million and that 12,000 machine-hours would be used. (a) Compute the predetermined indirect cost application...

-

Categorize each of the following costs as direct or indirect. Assume that a traditional costing system is in place.

-

Machine run costs Cost to market the product Machine depreciation Cost of storage Material handling costs Insurance costs Cost of materials Cost of product sales force Overtime expenses engineering...

-

Can you rewrite One company that has been recognized for its success in this area is Procter & Gamble (P&G).P&G is a consumer goods company that has implemented a comprehensive IBP process that...

-

Many police organizations seek input from external and internal actors when developing their organizational guidelines (policies and procedures). Some seek advice from the community and most, if not...

-

A faculty member is retiring, and a committee has been established to select a replacement. HR conducts candidate recruitment, and the selection committee proceeds through the interview process....

Study smarter with the SolutionInn App