The current price of stock ABC is 40. Stock ABC pays dividends continuously at a rate proportional

Question:

The current price of stock ABC is 40. Stock ABC pays dividends continuously at a rate proportional to its price. The dividend yield is 2%.

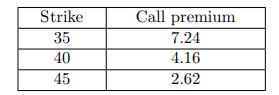

You are given the following premiums of one-year European call options on stock ABC for various strike prices:

The effective annual risk-free interest rate is 8%.

Let S(1) be the price of the stock one year from now.

Determine the range for S(1) such that a 35-strike short put produces a higher profit than a 45-strike short put, but a lower profit than a 40-strike short put.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: