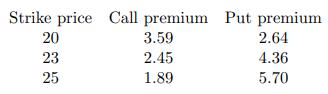

The following table shows the premiums of European call and put options having the same underlying stock,

Question:

The following table shows the premiums of European call and put options having the same underlying stock, the same time to expiration but different strike prices:

You use the above call and put options to construct an asymmetric butterfly spread with the following characteristics:

(i) The maximum payoff of 6 is attained when the stock price at expiration is 23.

(ii) The payoff is strictly positive as long as the stock price at expiration is strictly between 20 and 25.

Calculate your profit from the asymmetric butterfly spread if the stock price at expiration is 21

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: