The following table shows the premiums of European call and put options having the same nondividend-paying stock,

Question:

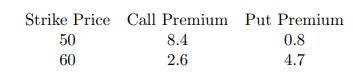

The following table shows the premiums of European call and put options having the same nondividend-paying stock, the same time to expiration but different strike prices:

An investor constructs a 50-60 long bear spread using the above options and breaks even at expiration.

Calculate the amount that the stock price at expiration should move from its current level.

Transcribed Image Text:

Strike Price Call Premium Put Premium 0.8 8.4 2.6 4.7 50 60

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

From the given table of option premiums it is possible to deduce the Tyear pres...View the full answer

Answered By

Bhartendu Goyal

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions. I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and help them achieve great subject knowledge. I have expertise in computer subjects like C++, C, Java, and Python programming and other computer Science related fields. Many of my student's parents message me that your lessons improved their children's grades and this is the best only thing you want as a tea...

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The following table shows the premiums of European call and put options having the same underlying stock, the same time to expiration but different strike prices: You use the above call and put...

-

The following table shows the prices of European call and put options with the same underlying asset, time to expiration, but different strike prices: Calculate the profit on a 17-23 long collared...

-

List three specific parts of the Case Guide, Objectives and Strategy Section (See below) that you had the most difficulty understanding. Describe your current understanding of these parts. Provide...

-

A hollow-fiber membrane device is operated to concentrate a bacterial suspension. The flow rate of cell suspension into the fibers is 350 kg/min. The inlet cell suspension is comprised of 1.0 wt%...

-

Identify the five groups of possible differences between pretax financial income and taxable income (or between income tax expense and income taxes payable).

-

China is a huge attractive market, with growing affluence. Before exporting to China, most firms conduct market research to acquire a fuller understanding of the countrys market situation. Two useful...

-

The balance sheet of Morrisey Management Consulting, Inc., at December 31, 2007, reported the following stockholders' equity: During 2008, Morrisey completed the following selected transactions:...

-

Petty Cash Mc Mann, Inc. decided to establish a petty cash fund to help ensure internal control over its small cash expenditures. The following information is available for the month of April. 1. On...

-

1. If the company uses the direct method of service department cost distribution, how much will the Machinery Department apply as factory overhead if it uses 13,500 direct labor hours? Jeang...

-

An investor wrote a 45-strike European call option on an index with three years to expiration. The premium for this option was 4. The investor also bought a 55-strike European call option on the same...

-

You are given that the price of a 70-strike call option is 8.3 and the price of a 80-strike call option is 2.7, where both options expire in one year and have the same underlying asset. The...

-

Lewis Printing has projected its sales for the first 8 months of 2016 as shown in the table below. January......................$100,000...................... February....................120,000...

-

A non dividend paying stock is trading at $45. What arbitrage opportunity is present if an American call option on the stock with an exercise price of $42 is trading at $2?

-

A non dividend paying stock is trading at $57. What arbitrage opportunity is present if an American call option on the stock with an exercise price of $60 is trading at $4?

-

You must decide whether to hold a fundraising event indoors or outdoors. There is a 30% likelihood of rain. If held outdoors, you estimate you can expect 1,000 attendees. If held indoors, you have a...

-

ABC,. Inc just paid a dividend of $13.13. The dividends are expected to grow by 17% in Years 1-4. After that, the dividends are expected to grow by 4% each year. If the required rate of return is...

-

Suppose there is an informed investor whose portfolio has a beta of 1.4 and an expected return of 16%. The market has an expected return of 10% and the risk-free rate is 4% (note: this means the...

-

Access the February 20, 2009, filing of the December 31, 2008, 10-K report of The Hershey Company (ticker HSY) at www.SEC.gov and complete the following requirements. Required Compute or identify the...

-

Choose a company from the SEC EDGAR Web site for your Key Assignment to evaluate for the impact of convergence to IFRS. Review the financial reports and notes of the company you have chosen from the...

-

Given the following four mutually exclusive alternative, sand using 8% for the MARR, which alternative should be selected? A D $75 First cost $50 $50 $85 Uniform annual benefit 16 12 10 17 Useful...

-

Consider the following three mutually exclusive alternatives: For what range of values of MARR is Alt, C the preferred alternative Put your answer in the following form: "Alternative C is preferred...

-

Consider four mutually exclusive alternatives, each having an 8-year useful life: If the minimum attractive rate of return is 8%, which alternative should be selected? A B D First cost Uniform annual...

-

On January 1, 2021, Flesh-n-Bone Corporation acquired 30% of Doug Corporation's 200,000 outstanding shares at P50 per share. Doug's net assets had a book value on the same date at P8,200,000. On the...

-

In Chicago, the temperature was -12 in the morning. It dropped 7 by the midnight. What was the temperature at midnight

-

Solve x" = -2x + y y" = x - 2y Note: Using the method of polynomial dfferential operators

Study smarter with the SolutionInn App