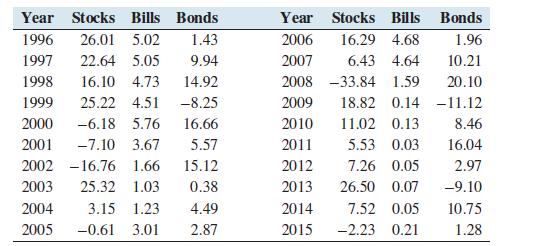

Following are the annual percentage returns for the years 19962015 for three categories of investment: stocks, Treasury

Question:

Following are the annual percentage returns for the years 1996–2015 for three categories of investment: stocks, Treasury bills, and Treasury bonds. Stocks are represented by the Dow Jones Industrial Average.

a. The standard deviation of the return is a measure of the risk of an investment. Compute the population standard deviation for each type of investment. Which is the riskiest? Which is least risky?

b. Treasury bills are short-term (1 year or less) loans to the U.S. government. Treasury bonds are long-term (30-year) loans to the government. Finance theory states that long-term loans are riskier than short-term loans. Do the results agree with the theory?

c. Finance theory states that the more risk an investment has, the higher its mean return must be. Compute the mean return for each class of investment. Do the results follow the theory?

Step by Step Answer: