First, develop the spreadsheet to confirm the replacement study decision conducted for Randall- Rico Consultants in Problem

Question:

First, develop the spreadsheet to confirm the replacement study decision conducted for Randall- Rico Consultants in Problem 11.31. Then answer the questions below posed by Mr. Randall in a meeting when he was informed of the results of the replacement study.

(a) I want to buy the new graphical plotter. What is the required purchase price of the new plotter to make me indifferent between buying it and keeping the old one?

(b) How much of a trade-in do I have to get for the old plotter to make me indifferent between retaining it (with the current ESL) and buying the new one? Is this the economically correct decision?

Problem 11.31

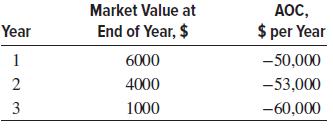

Randall-Rico Consultants, 5 years ago, purchased for $45,000 a microwave signal graphical plotter for corrosion detection in concrete structures. It is expected to have the market values and annual operating costs shown for its remaining useful life of up to 3 years. It could be traded now at an appraised market value of $8000.

A replacement plotter with new Internet-based, digital technology costs $125,000, has an estimated salvage value of 8% of the purchase price after its 5-year life, and an AOC of 20% of its purchase price. At an interest rate of 15% per year, determine how many more years Randall-Rico should retain the present plotter.

Step by Step Answer: