Question:

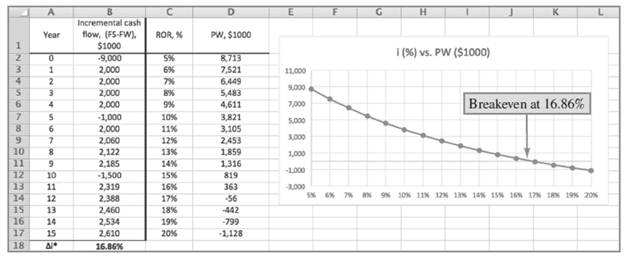

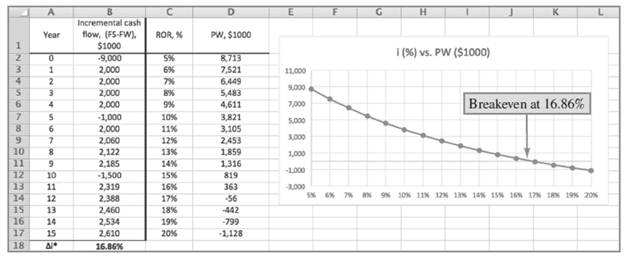

One of Suzanne€™s project engineers e-mailed her the screen-shot (below) of his spreadsheet analysis of the annual costs and savings for two equivalent systems considered for installation as a major upgrade of the fire and safety systems that reduce the possibility of human injury on the company€™s prime assembly line. He included the following statement in the e-mail: €œSince the company€™s

MARR is 20% per year, the extra investment in FirstSafe (FS) is not justified with a breakeven incremental ROR of 16.86%. However, with an exception to reduce the required return to 16%, or slightly above this, for this case only, FirstSafe is economically acceptable over FireWall (FW). Besides, I like the features on FirstSafe much better than those of the other, less expensive FW system. Can I go ahead and order the FirstSafe system?€ From all that you have learned in these last two chapters, would you recommend that Suzanne accept this analysis and respond €œYes€ to the request to purchase FirstSafe? If not satisfied, what additional information would you suggest that Suzanne request of her engineer?

MARR

Minimum Acceptable Rate of Return (MARR), or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other...

Transcribed Image Text:

G. н Incremental cash flow, (FS-FW), $1000 -9,000 Year ROR, % PW, $1000 i (%) vs. PW ($1000) 8,713 7,521 6,449 5% 2,000 2,000 2,000 2,000 -1,000 2,000 2,060 2,122 2,185 6% 11.000 7% 9,000 8% 5,483 Breakeven at 16.86% 6. 4,611 9% 7,000 10% 3,821 5.000 8. 11% 3,105 2,453 1,859 1,316 3.000 12% 13K 14% 10 1,000 -1,000 12 10 -1,500 15% 819 2,319 13 11 16% 363 3,000 5% 6% 7% 8x 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 14 12 2,388 2,460 2,534 17% -56 15 16 17 13 18% -442 14 19% -799 -1,128 15 2,610 20% 18 16.86%