The Johnsons had two children, both of them are married and now have their own families, call

Question:

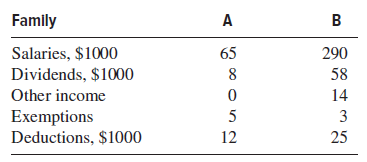

(a) Percentage of TI paid in federal taxes.

(b) Percentage of total income (salaries, dividends, and other) paid in federal taxes.

Exemptions are $4000 per individual (adult or child). Deductions for Family A are standard and itemized for B.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: