A hypothetical country has a surplus of $200 million in its budget for the fiscal year just

Question:

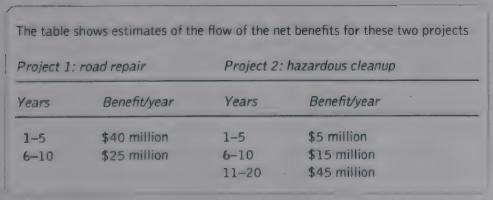

A hypothetical country has a surplus of $200 million in its budget for the fiscal year just ended. Several proposals have been examined for the use of this money, two of which are emerging as leading candidates for serious consideration. One of the favored projects is to use the entire surplus money for countrywide road repairs. This project is assumed to have an expected life of ten years. The alternative is a proposal to invest the entire $200 million in a long-overdue hazardous waste cleanup.

(a) Using the net present value (NPV) approach, evaluate the two projects using a 5 percent and 10 percent discount rate.

(b) Would it make any difference which discount rate is used in the final selection between these two projects?

Why, or why not?

(c) If the discount rate is reduced to zero, project 2 will be automatically chosen. Why? Does this provide a clue as to why discounting may be unfair? Explain.

Step by Step Answer:

Principles Of Environmental Economics And Sustainability

ISBN: 9780415676915

3rd Edition

Authors: Ahmed Hussen