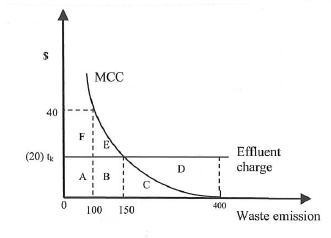

Refer back to Figure 5. 3. Let (mathrm{t}_{mathrm{k}}) now represent not effluent tax but subsidies. In other

Question:

Refer back to Figure 5. 3. Let \(\mathrm{t}_{\mathrm{k}}\) now represent not effluent tax but subsidies. In other words, the firm will be paid by the regulators \(t_{k}\) (i.e., \$20) for each unit of waste cleaned up.

a) Demonstrate that the final outcome will be the same (clean up 250 units of waste or control 150 units of waste) regardless whether the firm is charged tax or paid a subsidy

b) If the firm is paid a subsidy, it stands to earn a net gain of area \(\mathrm{D}\) in Figure 5. 3, and the government will lose area A + B in terms of tax receipt. Is it fair to reward a polluter in this way? What does this say about a policy that is purely focused on a "cost-effective" outcome?

Data from Figure 5.3

Step by Step Answer:

Principles Of Environmental Economics And Sustainability

ISBN: 9780815363545

4th Edition

Authors: Ahmed Hussen