As a telecommunications industry analyst at a brokerage firm, you are valuing Verizon Communications, Inc. (NYSE: VZ),

Question:

As a telecommunications industry analyst at a brokerage firm, you are valuing Verizon Communications, Inc. (NYSE: VZ), one of the world’s leading telecommunications companies.

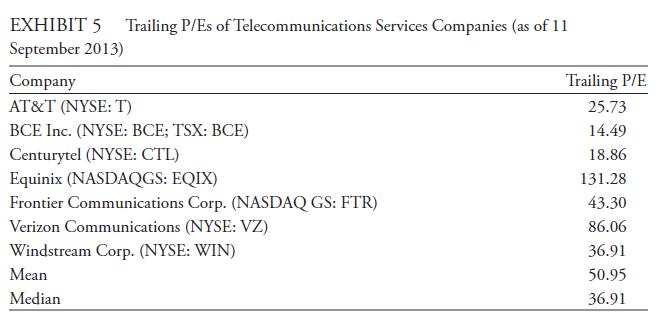

The valuation metric that you have selected is the trailing P/E. You are evaluating the P/E using the median trailing P/E of peer-group companies as the benchmark value.

According to GICS, VZ is in the telecommunications services sector and, within it, the integrated telecommunication services subindustry. Exhibit 5 presents the relevant data.

Based on the data in Exhibit 5, address the following:

i. Given the definition of the benchmark stated above, determine the most appropriate benchmark value of the P/E for VZ.

ii. State whether VZ is relatively fairly valued, relatively overvalued, or relatively undervalued, assuming no differences in fundamentals among the peer group companies. Justify your answer.

iii. Identify the stocks in this group of telecommunication companies that appear to be relatively undervalued when the median trailing P/E is used as a benchmark. Explain what further analysis

might be appropriate to confirm your answer.

Step by Step Answer: