You are analyzing three large-cap US stock issues with approximately equal earnings growth prospects and risk. As

Question:

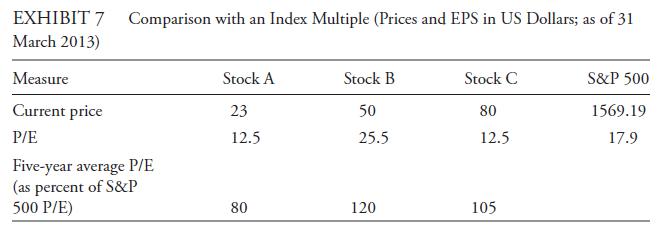

You are analyzing three large-cap US stock issues with approximately equal earnings growth prospects and risk. As one step in your analysis, you have decided to check valuations relative to the S&P 500 Composite Index. Exhibit 7 provides the data.

Based only on the data in Exhibit 7, address the following:

i. Explain which stock appears relatively undervalued when compared with the S&P 500.

ii. State the assumption underlying the use of five-year average P/E comparisons.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: